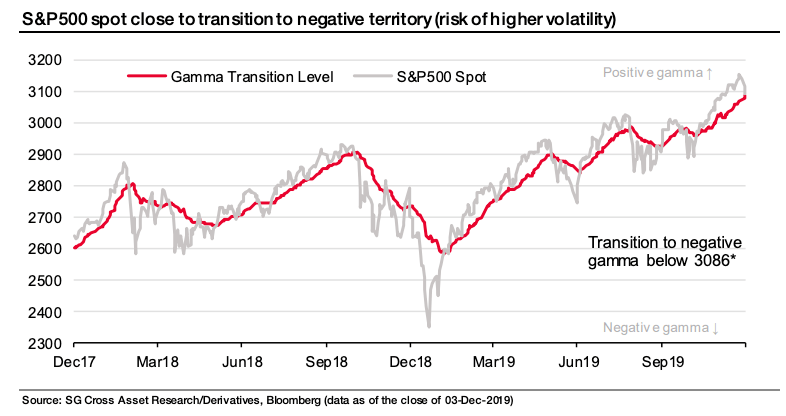

Here is a backtest of where SocGen calculates where positive gamma changes to negative gamma in the S&P500 (SPY). You can view our historical chart here. The concern is that a move through the zero gamma level may set a “gamma trap“.

Our FAQ has more information:

Zero Gamma Level: This is the estimated level at which dealers flip from “long gamma” to “short gamma”. Think of this indicator as the S&P500 level at which volatility shifts from low to high. When the market is above the indicator value traders and investors are more likely to see lower volatility markets due to the options dealers long gamma position . Below the indicator we an anticipate rapid, out-sized moves because dealers are short gamma. The volatility level indicator adjusts daily. Here is an analysis of markets moving through the volatility trigger.

Subscribers receive the zero gamma level to their email inboxes daily.