Here is a quick snapshot after the Saudi Oil attack – options gamma is still quite long with over $1bn long gamma per point in the S&P500. This may have had an effect on muting or “deleveraging” the reaction to the news about the Saudi Oil attack. There was a very large move in crude oil as seen in the chart here:

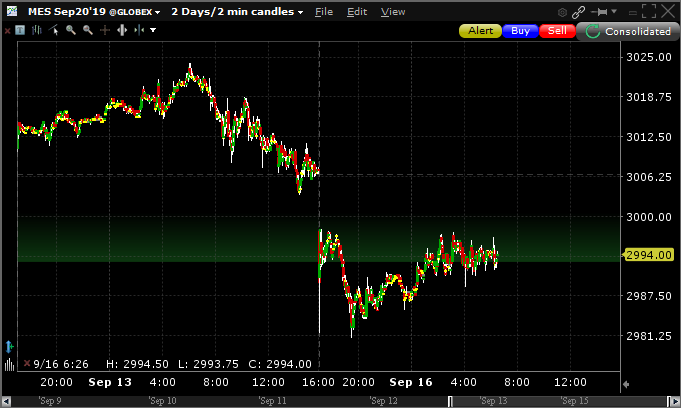

Compared to an initial drop in SPX Futures:

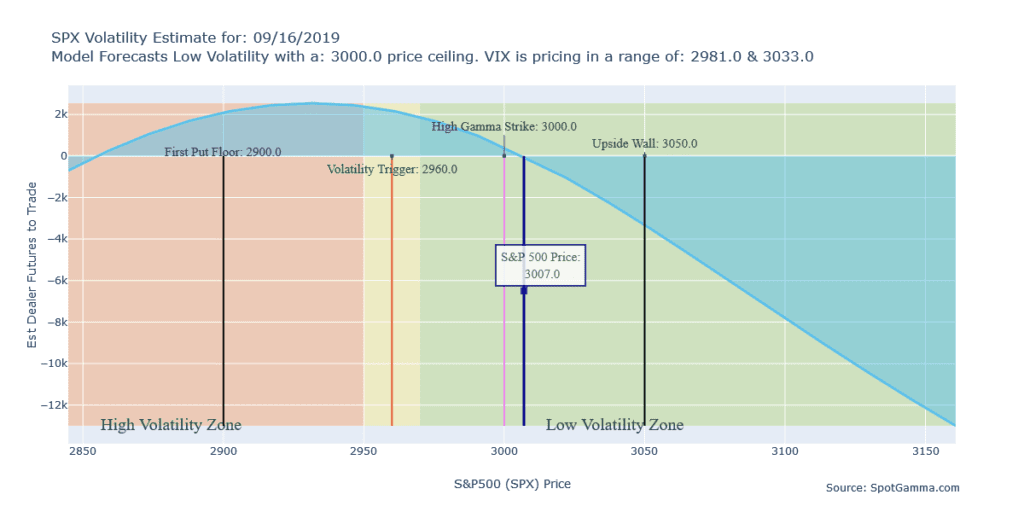

As our thinking goes, because S&P500 dealers are long so much gamma as soon as there is a drop in the S&P500 they must buy as a way to hedge. The sharper the initial drop, the more they must buy. This could be one of the reasons the futures (pre-open) are only down about 10 handles from Fridays close. Here is the current gamma run, you can see we are solidly in the “Low Volatility” area:

If the market gets down towards 2960 we see dealer gamma drop and turn to negative and this increases the odds of high volatility. It should also be noted that because there is a large options expiration Friday the levels of gamma can change without a substantial move in the S&P500. Also note that the Fed FOMC Rate Decision is Wednesday adding an external volatility factor.