The following is a guest post courtesy of Michael Kramer of Mott Capital Management. The S&P 500 has fallen by more than 10% in the past two weeks, and to say that it is due for a bounce may be an understatement. The combination of a 75 bps Fed rate hike and massive June quarterly options expiration resulted […]

FOMC

The Fed Meeting May Spark The Next Stock Market Rally

The following is a guest post courtesy of Michael Kramer of Mott Capital Management. Buy the Fed meeting. Sell the Fed minutes. It may be the name of the game for the stock market. At least since the start of 2022, the minutes have been a cause of concern for markets, while the FOMC meetings […]

Next Week’s Fed Meeting May Create Massive Moves In The Market

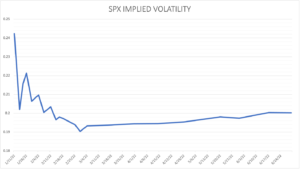

The following is a guest post courtesy of Michael Kramer of Mott Capital Management. Stock market volatility has picked up, and it may only be starting. Investors are eagerly awaiting the next FOMC meeting on January 26 to try and gauge which way the Fed may choose to go in its fight with inflation. With […]

‘Call AAA’: Santa Claus Is Having Sleigh Troubles

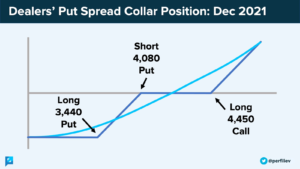

Through an options market lens, the following text will add color to some recent market movements.

A Volatility Crush Is Masking An Unhealthy Stock Market

The following is a guest post courtesy of Michael Kramer of Mott Capital Management. The S&P 500 finished the week ending September 24 up a mere 50 basis points, a tranquil week – on the surface. Volatility was fierce to start the week, a dynamic predicted by SpotGamma and shared with their subscribers last week. […]

This Might Not Be a September to Remember: Options Expiration + FOMC Risk

The following is a guest post courtesy of Michael Kramer of Mott Capital Management. The September monthly options expiration, which also happens to be a quarterly quadruple witching, occurs just days before the next FOMC meeting. As noted previously, the market appears to be anxious about this upcoming meeting, and it is easy to understand why. The prospects […]

SpotGamma’s FOMC Preview April ’20

Virus Outbreak – Week in Review

Ahead of important AAPL (Apple) earnings and the FOMC we wanted to review the market over the past week. We have spent a lot of time drawing an analogy between todays market and that of January ’18 (see here). Interestingly the Jan ’18 market topped the same day as the current market. Currently gamma is […]

Saudi Oil Attack Options Gamma

Here is a quick snapshot after the Saudi Oil attack – options gamma is still quite long with over $1bn long gamma per point in the S&P500. This may have had an effect on muting or “deleveraging” the reaction to the news about the Saudi Oil attack. There was a very large move in crude […]