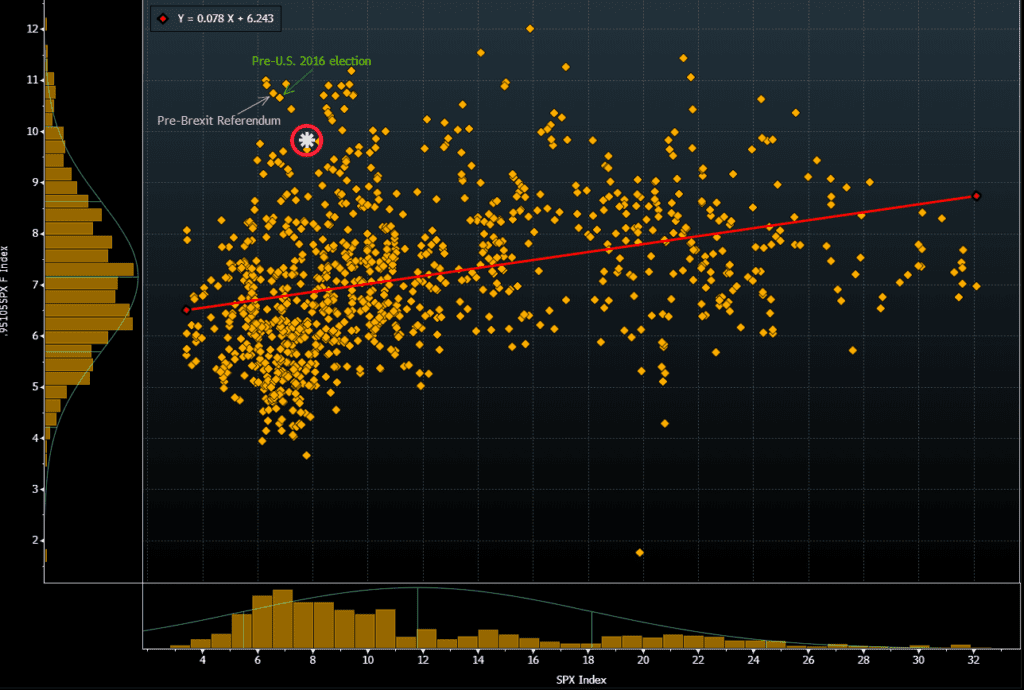

As per Bloomberg, Skew (which measures the price of calls vs puts) can often spike when investors are concerned about market risk. Puts will be in higher demand than calls and this moves the skew measurement higher. Currently skew is very high due to a slew of events in the next week: FOMC, BREXIT vote, China Tariff deadlines, impeachment and the possible government shutdown.

How Skew May Move Stock Markets

This presents an interesting situation as all that put buying may add a volatility dynamic to markets. When people buy puts dealers may hedge with selling futures. Currently most of these puts are well out of the money, and have a low delta. This means they require little hedging. But if the market was to move lower, the delta of those puts would start to increase (due to gamma) requiring more dealer selling in futures. Dealer selling could escalate quickly if the news or investor reaction to an event was bad enough. It could also cause the market to possibly “overreact” because of the momentum as dealers may need to sell more futures as the market moves lower (negative gamma).

Similarly, but to a lesser extent if the news is good all of these puts will expire or be sold and that can cause dealers to buy back these futures. This could impact the market by putting extra buying pressure.

See gamma trap for more explanation.