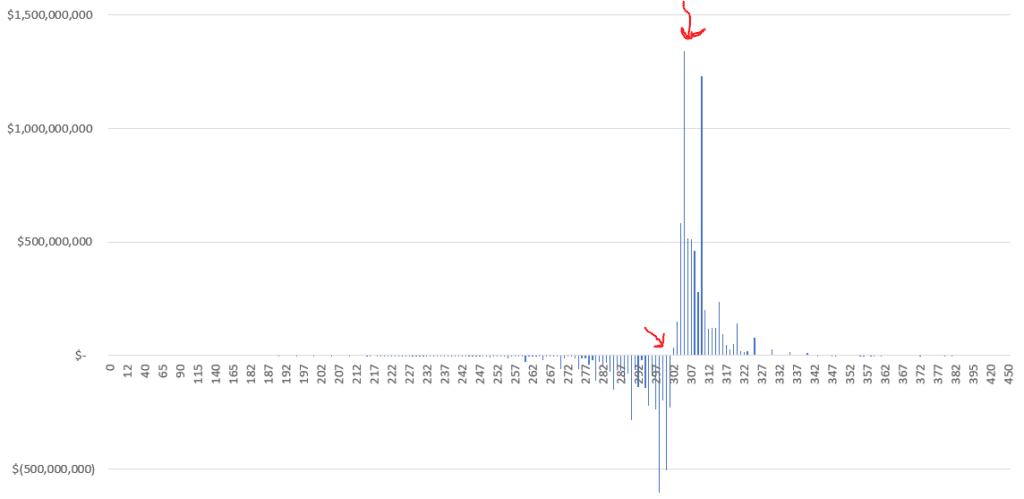

Below is a chart of gamma across all strikes in SPY. You can see that there is a large amount of gamma supply at 305 (right most arrow) and gamma flips from positive to negative around 301. It is below that strike where our model predicts increased volatility as dealers go from buyers to sellers.

There are a many ways you may chose to use this information, here are a few examples to research:

- Hedge or sell positions when market crosses the 0 gamma threshold

- Sell calls or close long positions when market approaches the “call wall” (295 in chart above)

- Short volatility when market is positive gamma territory, long volatility when it is below.

We provide a daily gamma snapshot and levels to subscribers.