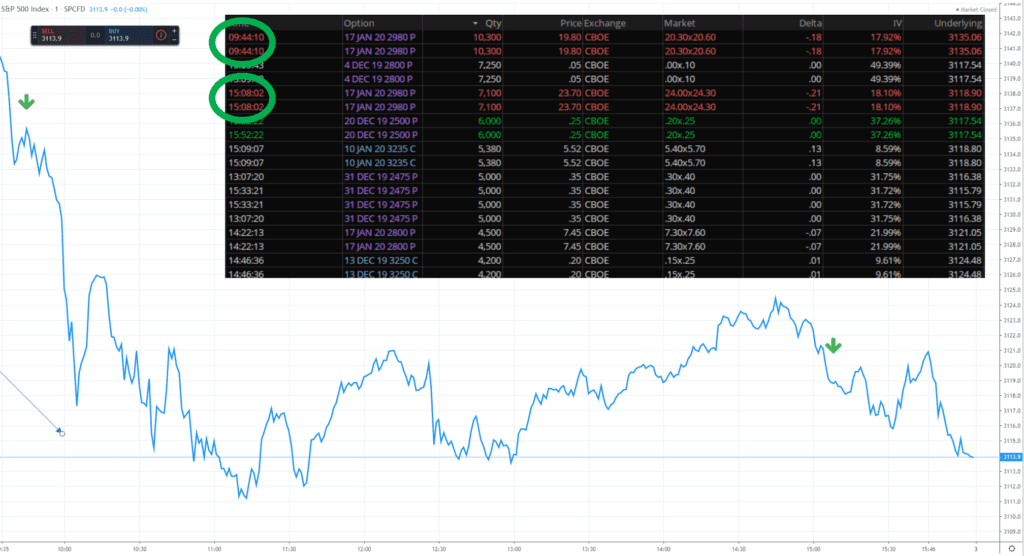

Interesting day in the market today as numerous China related headlines took away a futures rally that was testing all time highs. Its our view that much of the selling today was due to put buying. It seems there was a decent amount of slightly OTM puts trading, combined with a large move up in VIX leads us to believe traders were out hedging.

When people buy puts dealers are then short puts. To hedge themselves they must sell futures equivalent to the deltas of those puts. In theory these put deltas can move the market down if they are large enough size.

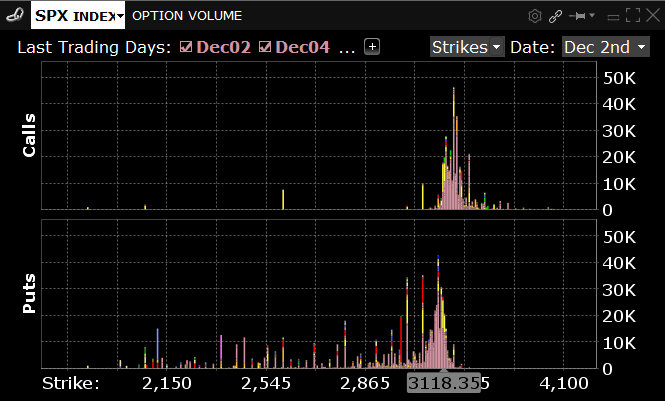

Not below the large put volume below where the market is trading (bottom row, left of 3118).

Note the move in the VIX below which was up substantially. The VIX is calculated off of the price of S&P options. If those options are being bought that drives their price up and therefore can move the VIX higher.

EDIT: There was a large trade done yesterday: Buy ~25k Jan 2980 puts. These had roughly a 20 delta and may have added as much as $1bn in futures to sell. A large chunk of that trade was done in the AM, and a second slug in the PM. You would think that $1bn notional isnt enought to crater the market – but I would note two things: 1) When dealers trade deltas they just “get them done”. i.e. they dont work the trade through the day. They need the hedge. 2) The trade went off when the market was already stumbling. Momentum started moving lower then this trade effectively jumped on board.