Subdued Vol Meets Negative Gamma

Weakness in AI-related stocks dominated market headlines last week, most notably for Oracle and Broadcom. This pushed the market downward, before the rebound on Thursday and Friday.

Despite the market trending down for three consecutive days, implied volatility remained surprisingly subdued: put skew remained average, and ATM implied volatility sat at just the 5th percentile. This suggests the market has been de-risking through stock selling rather than hedging with options. Consequently, VIX and VVIX each collapsed following Wednesday’s VIX, showing no significant bid for upside VIX calls.

As a result of quite low IV throughout the week, a recurring theme emerged: the options market consistently underpriced realized moves, with intraday ranges exceeding options-implied moves by 25-100 basis points across multiple sessions. If vol underprices potential event risks, such as last week’s CPI or OPEX, a negative gamma environment can amplify price action.

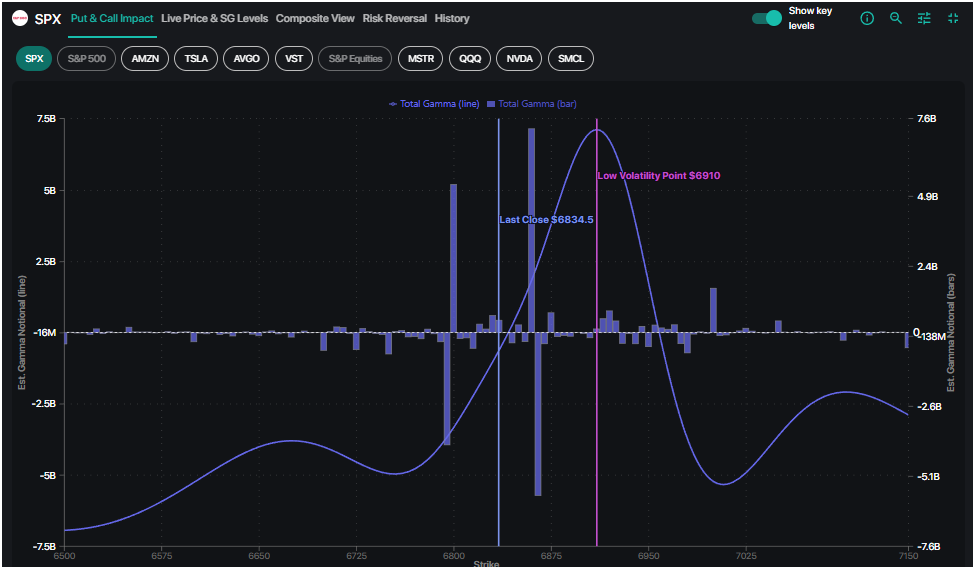

After Friday’s triple witching OPEX cleared significant positioning across the board, we now see positive gamma forming above Friday’s SPX close at 6,835. Positive gamma peaks around SPX 6,900, although massive positions at 6,860 – 6,865 could easily become a strong level of resistance.

Trading SPX: Highlights from Last Week

Given the cheap volatility last week, trading the negative gamma environment meant staying nimble and eyeing key gamma levels as the market bounced intraday. The most important level was the pivot point at SPX 6,790 – 6,800, with negative gamma below and positive gamma above.

Given the bullish lens and cheap options pricing, we entertained the December 31 SPX 7,000 calls on in our Founder’s Note last Monday. With just 9% implied volatility, the risk-reward was quite high for playing the upside tail into year-end. This position’s value ended up climbing more than 70% in the first 60 minutes of trading on both Thursday and Friday.

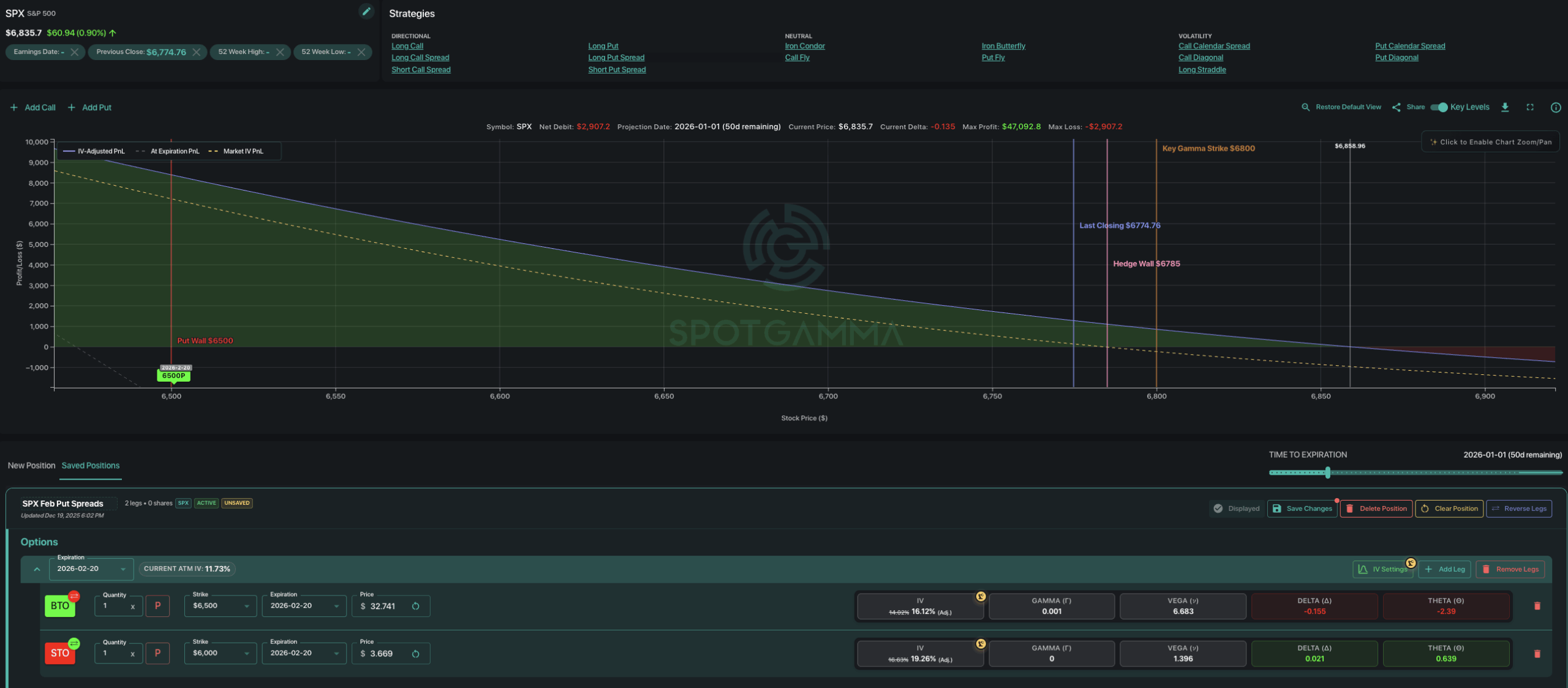

To capture downside, we mentioned February SPX 6,000 x 6,500 put spread in our December 15 subscriber webinar as a way to capture premium. If timed correctly, this could also be used to capitalize on a mean reversion scenario.

The put spread gained more than 20% after SPX dropped below 6,800 on Wednesday, as shown in the image of our Options Calculator below. This position demonstrates how longer-dated options can be used to avoid heavy time decay throughout holiday period.

The Approaching Holiday Window

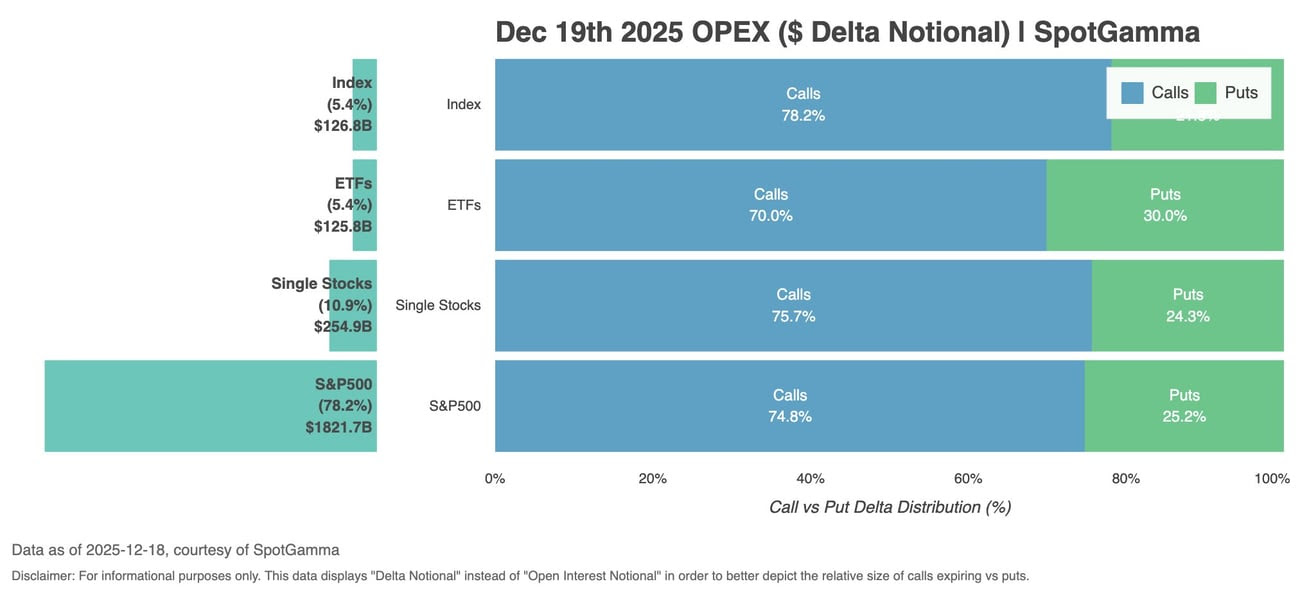

Last Friday brought us the quarterly Triple Witching OPEX, a massive expiration event which was notably call-heavy: 75% of expiring S&P 500 options delta came from calls.

This opens the “OPEXmas” window: We continue to view the period from OPEX (12/19) through Christmas week as bullish. Several factors support this thesis:

- Holiday Vol Decay: Time decay accelerates during low-liquidity holiday periods, punishing large premium positions and supporting equities.

- JPM 12/31 Call at 7,000: This ~2.75% above current levels provides a target and vol suppression mechanism.

- Seasonality: Historically, the OPEX→holiday window often produces a solid low-to-high. Last December, the market rallied from OPEX into Christmas before retracing the final week of the year.

After Christmas, the bull case weakens significantly. The holiday “decay tax” largely disappears, which could open up additional put buying. If traders start buying puts, negative gamma increases for dealers and their short vega exposure rises—meaning things could get jumpy. If SPX is sits below 6,800 after Christmas, we would lean more short vs. neutral.

At this time, we would like to remind our audience of the upcoming events and market closures for the rest of the year:

- Dec 24 (Wed): Christmas Eve – half day

- Dec 25 (Thu): Christmas – market closed

- Dec 26 (Fri): Trading resumes

- Dec 31 (Wed): JPM collar expiration

- Jan 1 (Thu): New Years – market closed

Vol remains cheap—creating both opportunity and risk. ATM IVs are 11-12% vs 16-17% during the similar November drawdown. If vol gets bid post-Christmas, stocks have very little support below. The lack of put buying so far means there’s “tinder” that could spark a fire if sentiment truly shifts.

As Warren Buffett once said: “The less prudence with which others conduct their affairs, the greater the prudence with which we should conduct our own affairs.”

When everyone is positioned on the same side, it’s probably time we should be at least a bit more cautious.