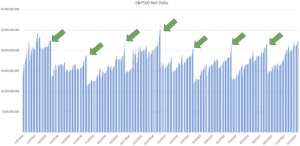

Much talk focuses on options market gamma and changes in gamma around expiration. But what may be the real catalyst around OPEX is a change in deltas, not gammas. When options expiration occurs (especially a large one like December) options are closed, expire or rolled. You therefore can have large positions change, which can cause […]

market delta

Why Track Gamma, Not Delta?

This question of why we track gamma and not delta comes up fairly often. (For those needed a level one primer on delta vs gamma go here: OptionsPlaybook. If you need a primer on options market makers check here.) Our belief is that when options market makers (MM’s) start and end each day delta neutral. […]