The following is a guest post from Doug Pless. As I have discussed previously, my trading strategy is to look for long positions in stocks with actively traded options early in the week. At the end of week, as out of the money calls start to lose value and/or traders enter bearish options trades, my […]

Guest Post

Playing Friday’s Move Lower in ES Futures

This is a guest post from professional trader David Blake. Friday saw a decent down day for a change and all being well we’ll see more like this in the weeks ahead. I wanted to share how useful again the spotgamma unicorn levels were to me on trades during Friday RTH allowing me to trade […]

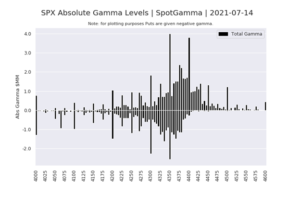

The Unclenching Of Gamma May Unleash The Overbought Stock Market

The following post is courtesy of Michael Kramer of Mott Capital Management. Reach him on Twitter. Since the big June options expiration, US equity markets have run sharply higher. Starting on June 18, the S&P 500 has gained an unexpected 5%. The move higher has come despite many economic reports suggesting the economy may have […]

Trader Doug Pless: Use Real Time Options Flow To Confirm Your Thesis

Doug is a full time trader from the US focusing on futures and equities. Reached him on twitter! As we have discussed previously, many traders open bullish option positions early in the week with short-term options that expire at the end of week. As traders buy calls and sell puts, market makers take the opposite […]

Trader David Blake & ES “Unicorn Levels”

This post is courtesy of David Blake, a full time trader from the UK. He can be reached on Twitter. I always have loved the London open and that harks back to my forex trading days. ETH (extended trading hours) often has a simpler rhythm to it, keep an eye of what the European markets […]