Macro Theme: Key Levels: Macro Note TBA Reference Price: 4045 SG Implied 1-Day Move: 0.9% SG Implied 5-Day Move: 2.55% Volatility Trigger: 4020 Absolute Gamma Strike: 4000 Call Wall: 4200 Put Wall: 3900 Upcoming Market Events Tuesday, March 07 (10am EST): Fed Chair Powell speech Wednesday, March 08 (10am EST): Fed Chair Powell hosts Q&A […]

Staging

Founder’s Note for: 2023-03-03 05:45 PM EST

Macro Theme: Key Levels: Macro Note TBA Reference Price: 3981SG Implied 1-Day Move: 0.9%SG Implied 5-Day Move: 2.7%Volatility Trigger: 3975Absolute Gamma Strike: 4000Call Wall: 4200Put Wall: 3900 Big Picture Cash Open Cash Close VIX 19.42 18.5 (-0.92) ES [March futures] 4005 4050 (+45) NQ [March futures] 12134.75 12317.00 (+182.25) Upcoming Market Events March 10 (Friday […]

Founder’s Note for: 2023-03-01 16:58 PM EST

Macro Theme: Key Levels: Macro Note TBA Ref Price: 3944 SG Implied 1-Day Move: 0.91% SG Implied 5-Day Move: 2.7% Volatility Trigger: 3995 Absolute Gamma Strike: 4000 Call Wall: 4200 Put Wall: 3900 Daily Note: NOTE TO FOLLOW SpotGamma Proprietary SPX Levels Latest Data SPX Previous SPY NDX QQQ Ref Price: 3944 3969 394 11929 […]

Founders Note for: 2023-02-20 15:31 PM EST

Macro Theme: Key Levels: Macro Note TBA Ref Price: 4078 SG Implied 1-Day Move: 0.98% SG Implied 5-Day Move: 2.33% Volatility Trigger: 4060 Absolute Gamma Strike: 4000 Call Wall: 4200 Put Wall: 3900 Daily Note: NOTE TO FOLLOW SpotGamma Proprietary SPX Levels Latest Data SPX Previous SPY NDX QQQ Ref Price: 4078 4078 407 12358 […]

Founders Note for: 2023-02-10 07:09 AM EST

Macro Theme: Key Levels: Macro Note TBA Ref Price: 4081 SG Implied 1-Day Move: 1.0% SG Implied 5-Day Move: 2.85% Volatility Trigger: 4095 Absolute Gamma Strike: 4000 Call Wall: 4200 Put Wall: 3900 Daily Note: NOTE TO FOLLOW SpotGamma Proprietary SPX Levels Latest Data SPX Previous SPY NDX QQQ Ref Price: 4081 4081 407 12381 […]

Founders Note for: 2023-02-09 07:42 AM EST

Macro Theme: Key Levels: Macro Note TBA Ref Price: 4118 SG Implied 1-Day Move: 1.28% SG Implied 5-Day Move: 2.85% Volatility Trigger: 4095 Absolute Gamma Strike: 4000 Call Wall: 4200 Put Wall: 3900 Daily Note: NOTE TO FOLLOW SpotGamma Proprietary SPX Levels Latest Data SPX Previous SPY NDX QQQ Ref Price: 4118 4118 410 12495 […]

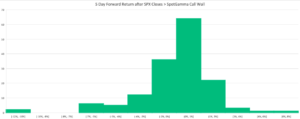

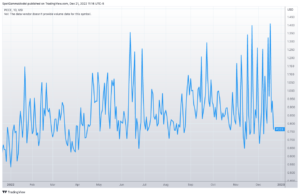

SPX vs SpotGamma Call Wall, Put Wall

Listed here are some helpful statistics around two of SpotGamma’s key proprietary support and resistance levels: The SPX Call Wall & Put Wall These levels are derived purely from options positioning. This data is based off of 1265 trading days, ending 1/20/2023. SPX Call Wall As you can see here, the SPX tends to have […]

Founders Note for: 2023-01-27 06:41 AM EST

Macro Theme: Key Levels: > Major resistance: $4,065 (SPX Large Gamma)> Pivot Level: $4,000> Major Support: $3,950> Critical support: $3,900 (SPX Put Wall)> Key Dates: 2/1 FOMC> Major risk lies on a break of 4000, as dealers may flip to negative gamma hedging Ref Price: 4060SG Implied 1-Day Move: 1.08%SG Implied 5-Day Move: 2.86%Volatility Trigger: […]

Founders Note for: 2023-01-02 15:27 PM EST

Macro Theme: Key Levels: Macro Note TBA Ref Price: 3839 SG Implied 1-Day Move: 1.28% SG Implied 5-Day Move: 2.89% Volatility Trigger: 3855 Absolute Gamma Strike: 4000 Call Wall: 4000 Put Wall: 3700 Daily Note: NOTE TO FOLLOW SpotGamma Proprietary SPX Levels Latest Data SPX Previous SPY NDX QQQ Ref Price: 3839 3839 382 10939 […]

Protected: The Put/Call Fallacy

There is no excerpt because this is a protected post.