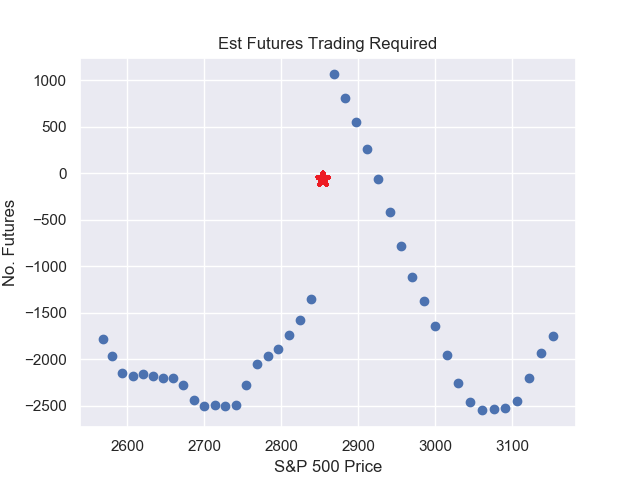

Here is a chart estimating the futures action with the S&P500 at 2850. If markets head lower it looks like dealers will sell more futures, compounding the move down. The same works in a rally, but instead of selling those dealers will be buying. All this flips when/if the market moves over the VFLIP line of 2920.

As an addendum to this, here is a futures liquidity chart from Goldman Sachs. You can see that in the current market only $10 million notional is required to move the market one tick. 1000 S&P Emini Futures is about $140 million dollars. That would have impact.