On April 22, 2025, S&P 500 futures (ES) launched higher out of the gate in a powerful bullish opening drive, and SpotGamma tools offered a clear roadmap before the move began. TRACE signaled a high-volatility environment, with a low Stability Index and elevated Gamma sensitivity, while HIRO showed early bullish flow that confirmed market maker hedging pressure. Combined with precise Gamma levels from SPX and SPY, this setup offered traders a chance to ride the move with tight stops and high reward potential.

Here’s how SpotGamma’s tools helped identify the setup, time the entry, and manage the exit with clarity and confidence.

Author: Doug Pless

Professional Trader & SpotGamma Content Contributor

The Setup |

The Tools |

The Execution |

The Payoff |

|

• Instrument: ES Futures (S&P 500) |

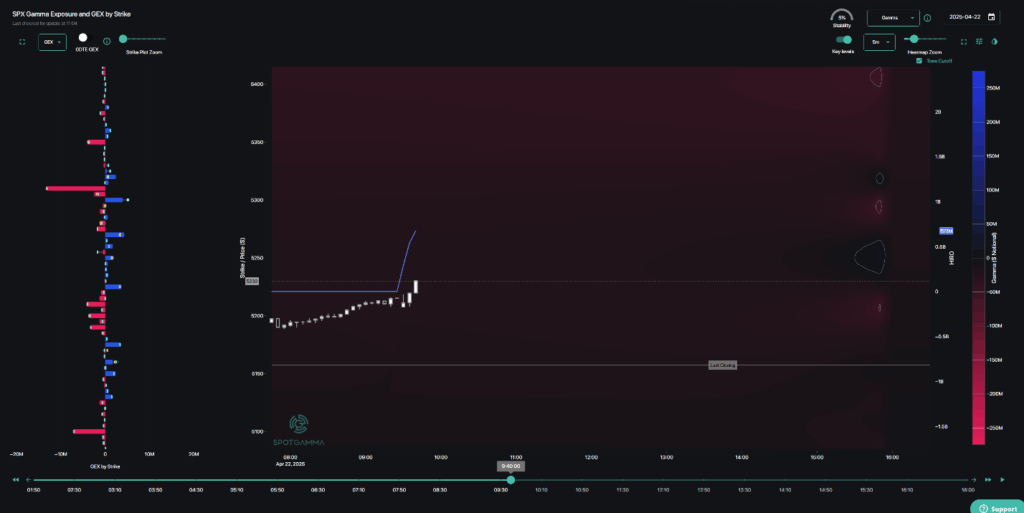

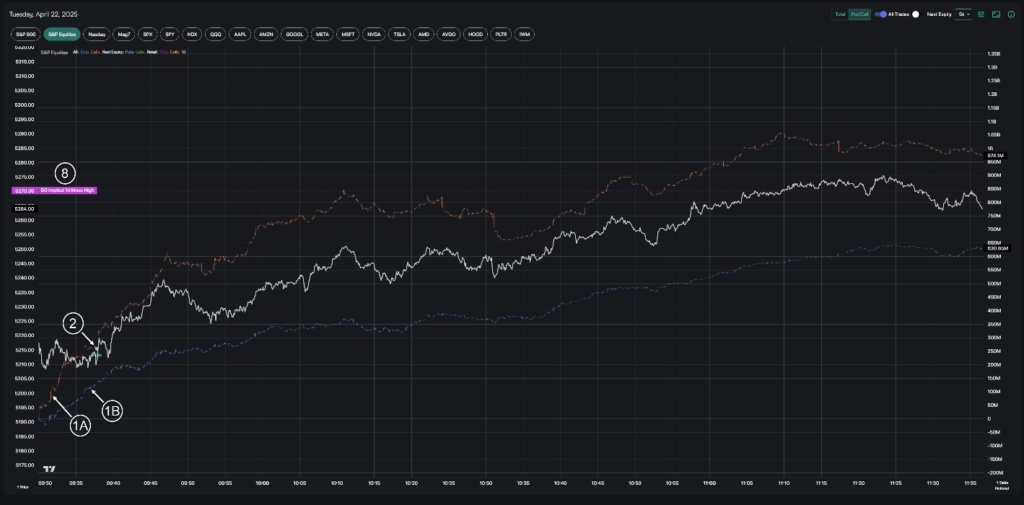

TRACE • Gamma Heatmap showed low Stability Index (5%) • Negative gamma environment → sharp directional potential HIRO • Early bullish flow: • Call buying and put selling • Dealers forced to buy ES to hedge • Flow Alert triggered on SPY 520 breakout Bookmap • Used for visual confirmation at gamma levels • Helped guide entry/exit timing with volume/liquidity zones |

• Entry: 5255.75 (ES), after pullback to SPX 5225 Combo 2 level • Trigger: Confirmed HIRO flow + price reaction at support • Targets: • SPX 5250 (ES 5278) • SPY 525 Large Gamma 2 (ES 5295) • SPX 5270.36 1-Day High (ES 5298.5) • Stop: 5 points below entry • Exit: Scaled out at each level, final exit near 5298.5 |

• Result: Profitable trade with layered exits • Range Captured: ~43 points from entry to top • Flow Exhaustion: HIRO showed fade ~10 min after 5270 hit • Lesson: TRACE + HIRO provided actionable insight for timing both entry and exit in a volatile directional setup |

TRACE Gamma Heatmap (9:40 am ET)

SpotGamma HIRO Signal

Bookmap Chart

- Use TRACE to identify high-volatility opportunities — A low Stability Index and negative Gamma can signal strong directional potential early in the day

- HIRO confirms real-time options activity — Call buying and put selling at the open told us market makers would need to hedge by buying ES, adding fuel to the rally

- Gamma levels provide structure for entries and exits — SpotGamma’s SPX and SPY levels helped define pullback entries and layered profit targets

- Flow exhaustion signals the exit — HIRO showed bullish flow fading shortly after the final gamma target was reached, helping lock in profit at the right time

Need a quick term check? Head to the Support Center — it’s your cheat sheet for SpotGamma tools and market terms.