Macro Theme: |

Key Levels: |

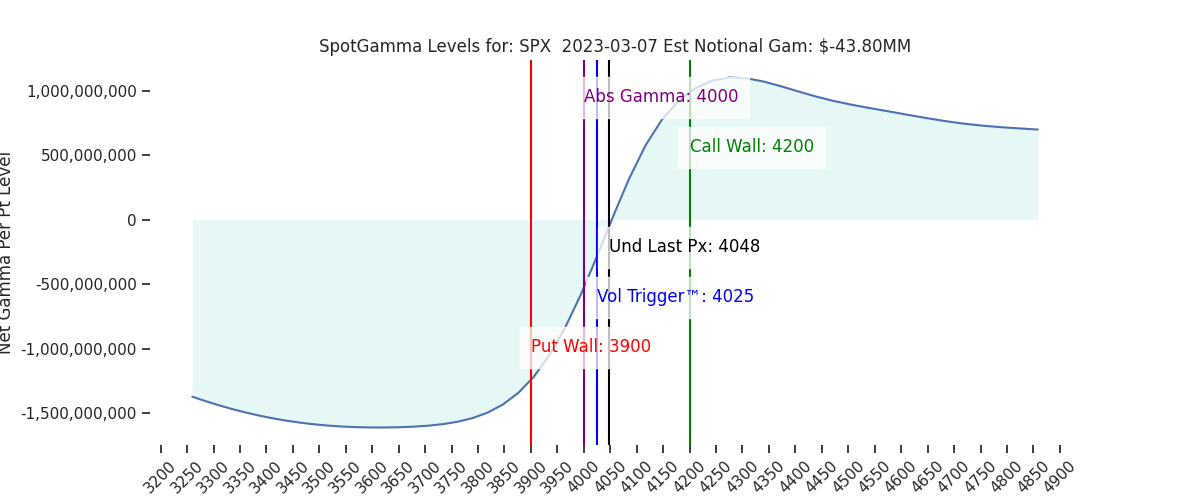

| > Major Resistance: $4,100 > Pivot Level: $4,000 > Critical Support: $3,900 (SPX Put Wall) > Key Dates: 3/17 opex (Quad Witching) > 3/31 opex (JPM collar roll) > Major risk lies on a break of 3900. | Reference Price: 4048 SG Implied 1-Day Move: 0.87% SG Implied 5-Day Move: 2.55% Volatility Trigger: 4025 Absolute Gamma Strike: 4000 Call Wall: 4200 Put Wall: 3900 |

Upcoming Market Events

Tuesday, March 14 (8:30am EST): CPI

Wednesday, March 15 (8:30am EST): PPI

Friday, March 17: Monthly Opex (Quad Witching)

Wednesday, March 22 (2pm EST): Fed Interest Rate Decision

March 31 (Friday): JPM Collar Roll for JHEQX

What’s Happening in the Market

Gamma Spotlight

Largest Catalysts of the Day

Details on the Catalysts

HIRO

Market Structure

Conclusion

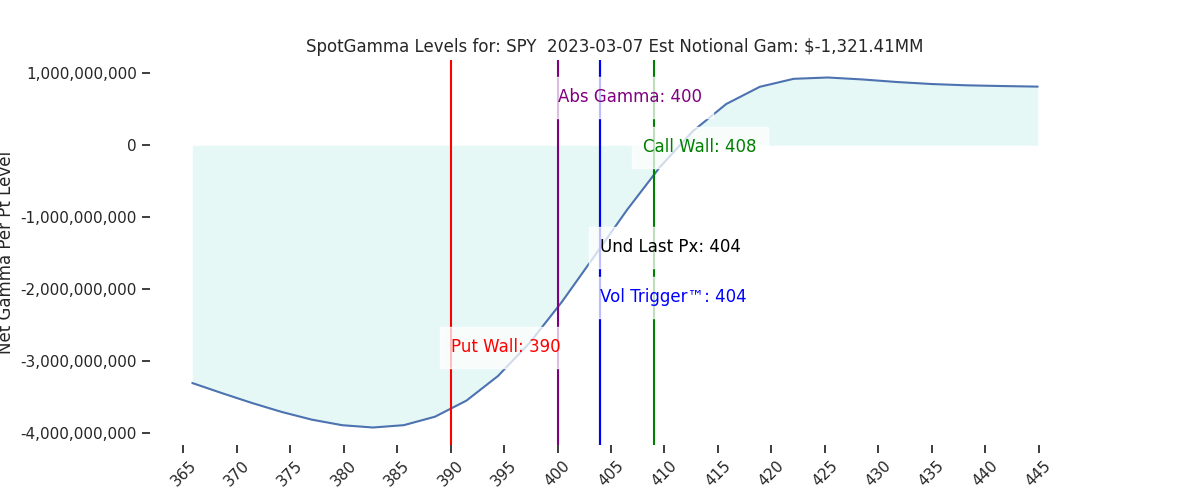

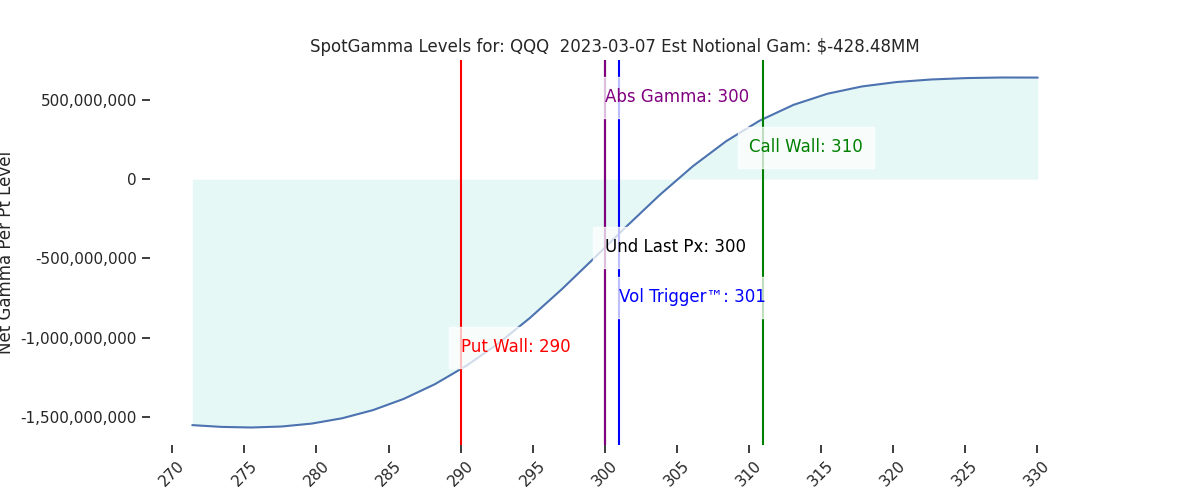

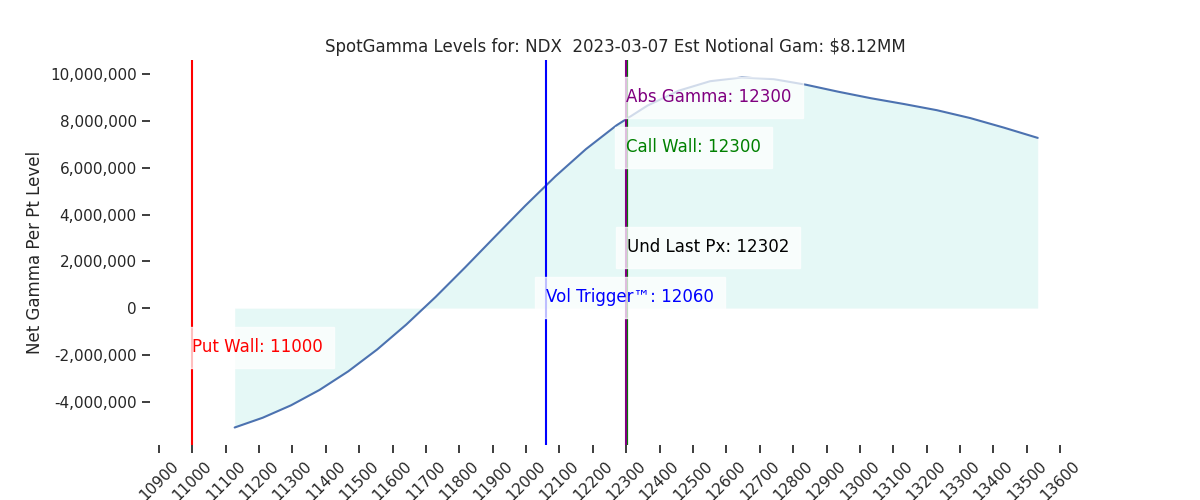

| SpotGamma Proprietary SPX Levels | Latest Data | SPX Previous | SPY | NDX | QQQ |

|---|---|---|---|---|---|

| Reference Price: | 4048 | 4050 | 404 | 12302 | 300 |

| SG Implied 1-Day Move: | 0.87%, | (±pts): 35.0 | VIX 1 Day Impl. Move:1.18% | ||

| SG Implied 5-Day Move: | 2.55% | 4045 (Monday Reference Price) | Range: 3942.0 | 4149.0 | ||

| SpotGamma Gamma Index™: | 0.08 | 0.26 | -0.31 | 0.05 | -0.08 |

| Volatility Trigger™: | 4025 | 4020 | 404 | 12060 | 301 |

| SpotGamma Absolute Gamma Strike: | 4000 | 4000 | 400 | 12300 | 300 |

| Gamma Notional (MM): | -44.0 | 95.0 | -1321.0 | 8.0 | -428.0 |

| Call Wall: | 4200 | 4200 | 408 | 12300 | 310 |

| Put Wall: | 3900 | 3900 | 390 | 11000 | 290 |

| Additional Key Levels | Latest Data | Previous | SPY | NDX | QQQ |

|---|---|---|---|---|---|

| Zero Gamma Level: | 4030 | 4032 | 410.0 | 11646.0 | 309 |

| Gamma Tilt: | 1.02 | 1.04 | 0.7 | 1.58 | 0.79 |

| Delta Neutral Px: | 3984 | ||||

| Net Delta (MM): | $1,513,547 | $1,506,888 | $182,802 | $52,364 | $99,635 |

| 25 Day Risk Reversal: | -0.03 | -0.03 | -0.02 | -0.02 | -0.03 |

| Call Volume: | 582,213 | 578,470 | 1,830,158 | 8,178 | 717,805 |

| Put Volume: | 916,035 | 1,013,513 | 2,739,721 | 9,122 | 1,259,849 |

| Call Open Interest: | 6,342,322 | 6,282,218 | 6,503,512 | 64,720 | 4,939,412 |

| Put Open Interest: | 11,075,667 | 10,922,567 | 13,677,566 | 64,015 | 8,568,474 |

| Key Support & Resistance Strikes: |

|---|

| SPX: [4100, 4050, 4000, 3950] |

| SPY: [410, 405, 400, 390] |

| QQQ: [305, 300, 295, 290] |

| NDX: [13000, 12500, 12300, 12000] |

| SPX Combo (Strike, Percentile): [(4198.0, 96.3), (4174.0, 86.64), (4150.0, 94.28), (4125.0, 87.43), (4105.0, 76.87), (4101.0, 95.63), (4085.0, 79.11), (4077.0, 90.99), (4065.0, 94.67), (4004.0, 87.06), (4000.0, 95.89), (3976.0, 81.24), (3955.0, 85.17), (3951.0, 95.19), (3927.0, 78.56), (3903.0, 86.78), (3899.0, 96.94), (3874.0, 82.39), (3854.0, 83.74), (3850.0, 90.79)] |

| SPY Combo: [389.5, 419.44, 399.62, 409.73, 394.76] |

| NDX Combo: [12302.0, 11896.0, 12708.0, 12093.0, 12512.0] |

| ©TenTen Capital LLC d.b.a. SpotGamma Please leave us a review: Click Here |

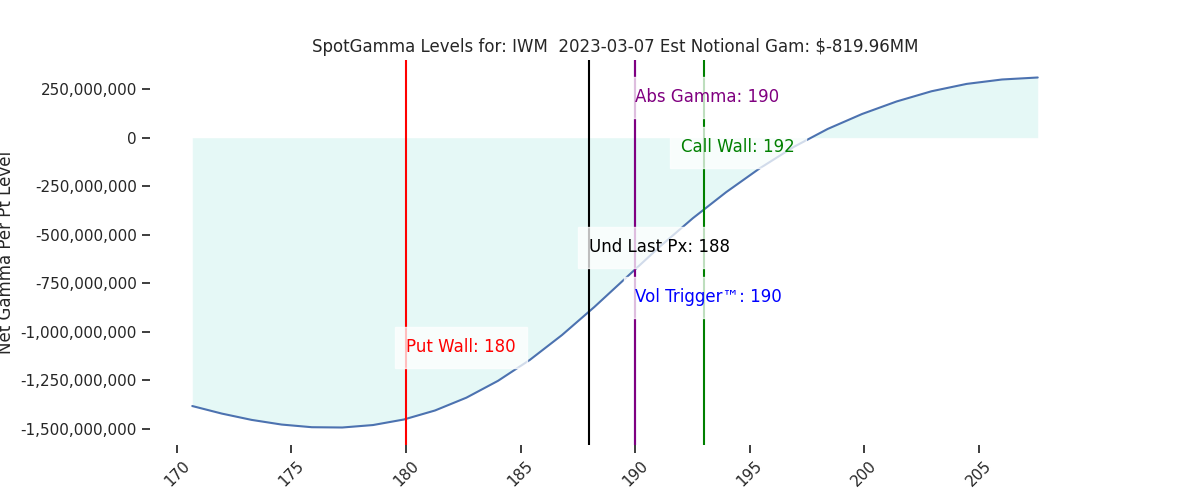

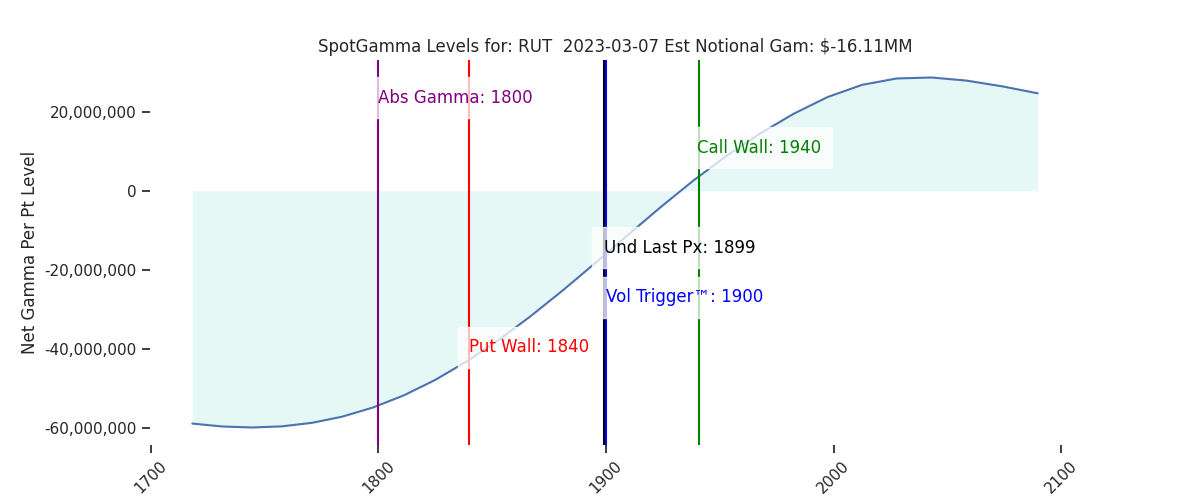

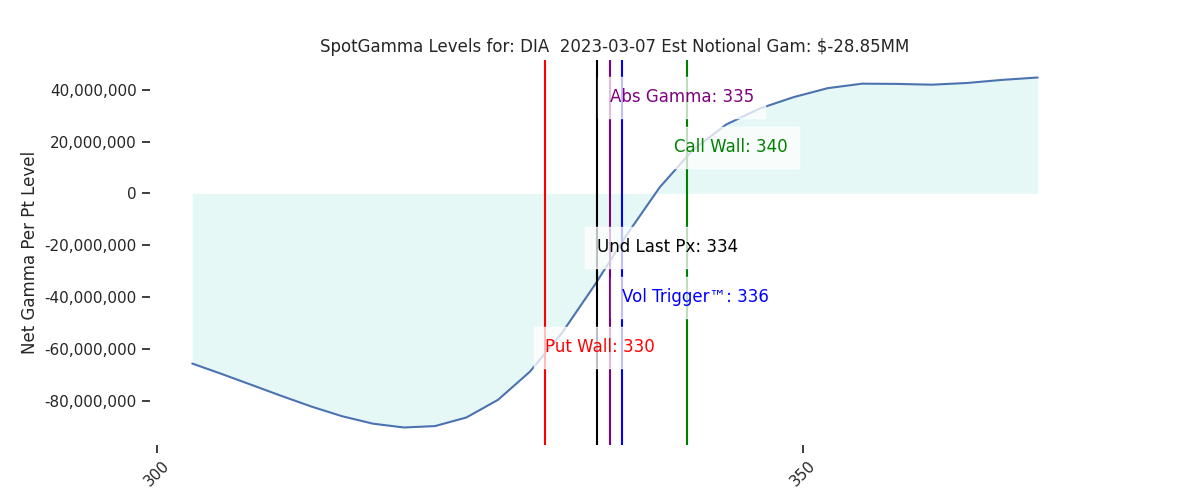

| See the FAQ for more information on reading the SpotGamma graph. |

| SpotGamma provides this information for research purposes only. It is not investment advice. SpotGamma is not qualified to provide investment advice, nor does it guarantee the accuracy of the information provided. This email is intended solely for subscribers, please do not distribute the information without the express written consent of SpotGamma.com. |