Record 0DTE Volume in 2025 Has Changed the Game

We wrapped up 2025 with the S&P 500 up 18% for the year—a solid result in the face of tariff headlines, global conflicts, and inflation concerns. One of the major options market stories of the past year has been the growing role of 0DTE options: same-day expiration contracts experienced record activity in 2025, with as much as 60% of SPX options volume coming from 0DTE transactions.

The massive inflow of short-dated activity indicates increasingly speculative retail flow and extreme FOMO as the bull market moves forward. This also means that 0DTE options will likely continue to deliver an outsized influence to the broader market.

Like any options transactions, 0DTE trades are hedged by dealers who buy or sell stock to remain delta netural. On many occasions, SPX 0DTE flows (including trades from Captain Condor) provide important intraday support and resistance levels when calls and puts are sold by traders: when dealers are long options, they must sell underlying stock or futures as price rallies, or buy as price dips—stabilizing price action and reducing realized volatility.

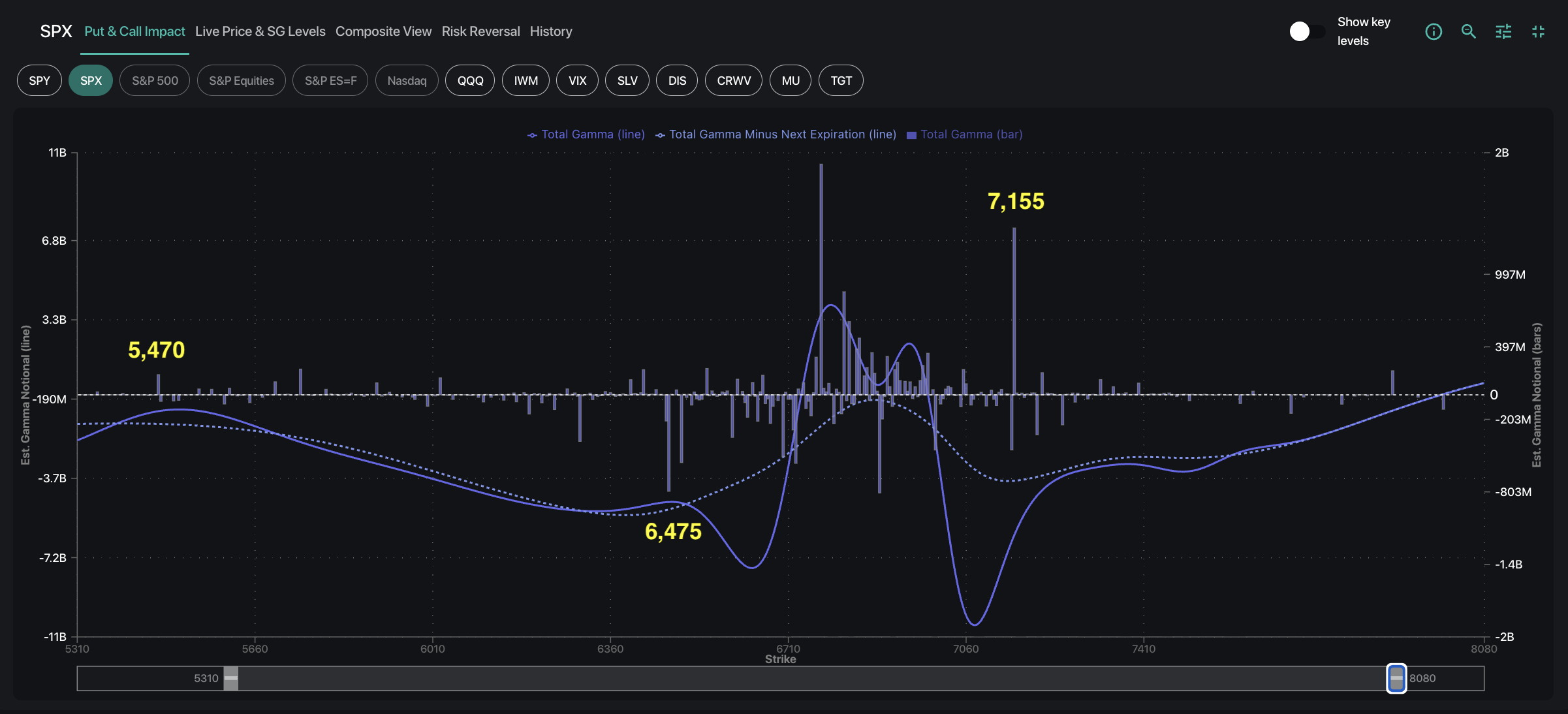

However, these short-dated contracts expire quickly, which can in turn lead to erratic price action as dealer hedges rapidly unwind. Looking at the current SPX gamma profile in the chart below, 0DTE flows continue to supply positive gamma while longer dated dealer exposure remains negative-to-neutral (indicated by the dotted line). This means that market stability remains tenuous, dependent on the daily entrance of short-dated options sellers.

The above gamma chart also reveals the emergence of the new JPM Collar Trade: this quarter, the collar consists of a sold 7,155 call and a bought 6,475 x 5,470 put spread, each with a March 31 expiration. These strikes represent important structural levels of support and resistance to monitor as we move into the first quarter of 2026.

Silver’s Speculative Blow-Off

While equity volatility remained relatively subdued last week, precious metals—particularly silver—dominated FinTwit, with extreme implied volatility drawing attention.

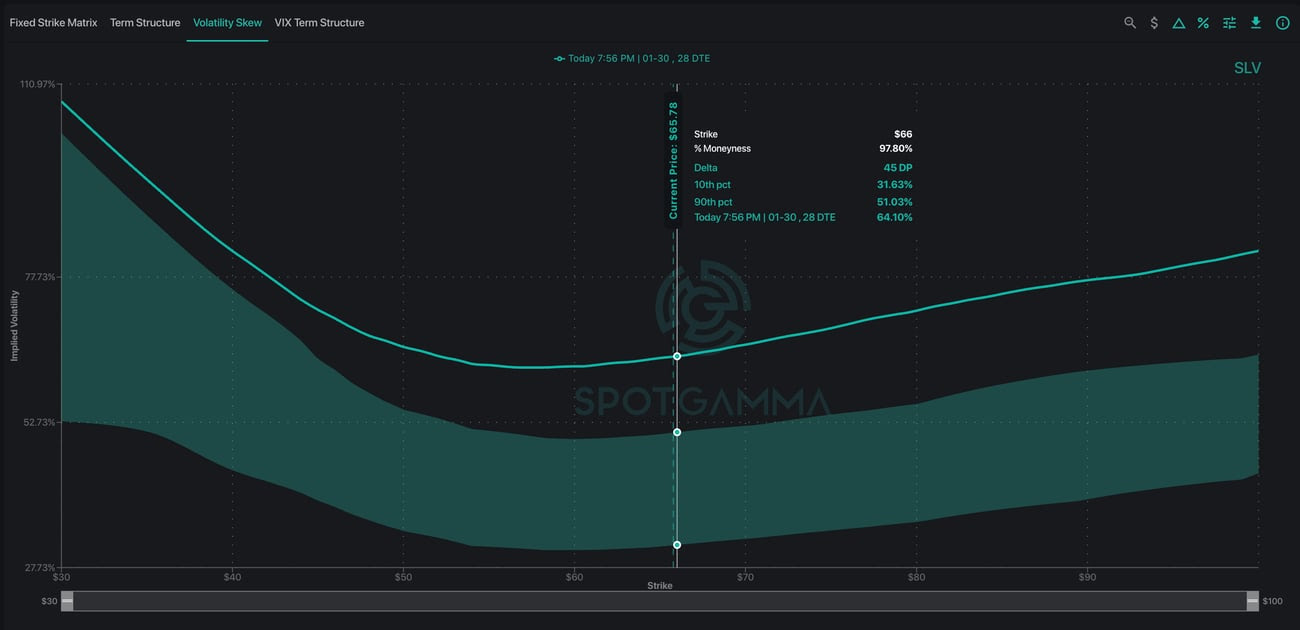

Looking at silver via SLV, it entered the week at 100% IV Rank with steep put skew, a warning sign of crowded positioning with risk of reversal. Daily options volume surged to 1-2 million contracts while open interest failed to grow proportionally, which highlighted chase-driven, FOMO-style speculation.

By the end of last week, both call and put skew steepened further, even as SLV sold off sharply. This indicated continued heavy activity in SLV options rather than meaningful position cleanup.

SLV implied volatility pushed above the 90th percentile of its 90-day range (green shaded area). The Term Structure similarly showed a spike in Forward IV into January 9, which may be tied to index-related flows, per recent Bloomberg reports. SLV remains a fascinating name to monitor as January unfolds.

Growing Signs of Volatility Expansion

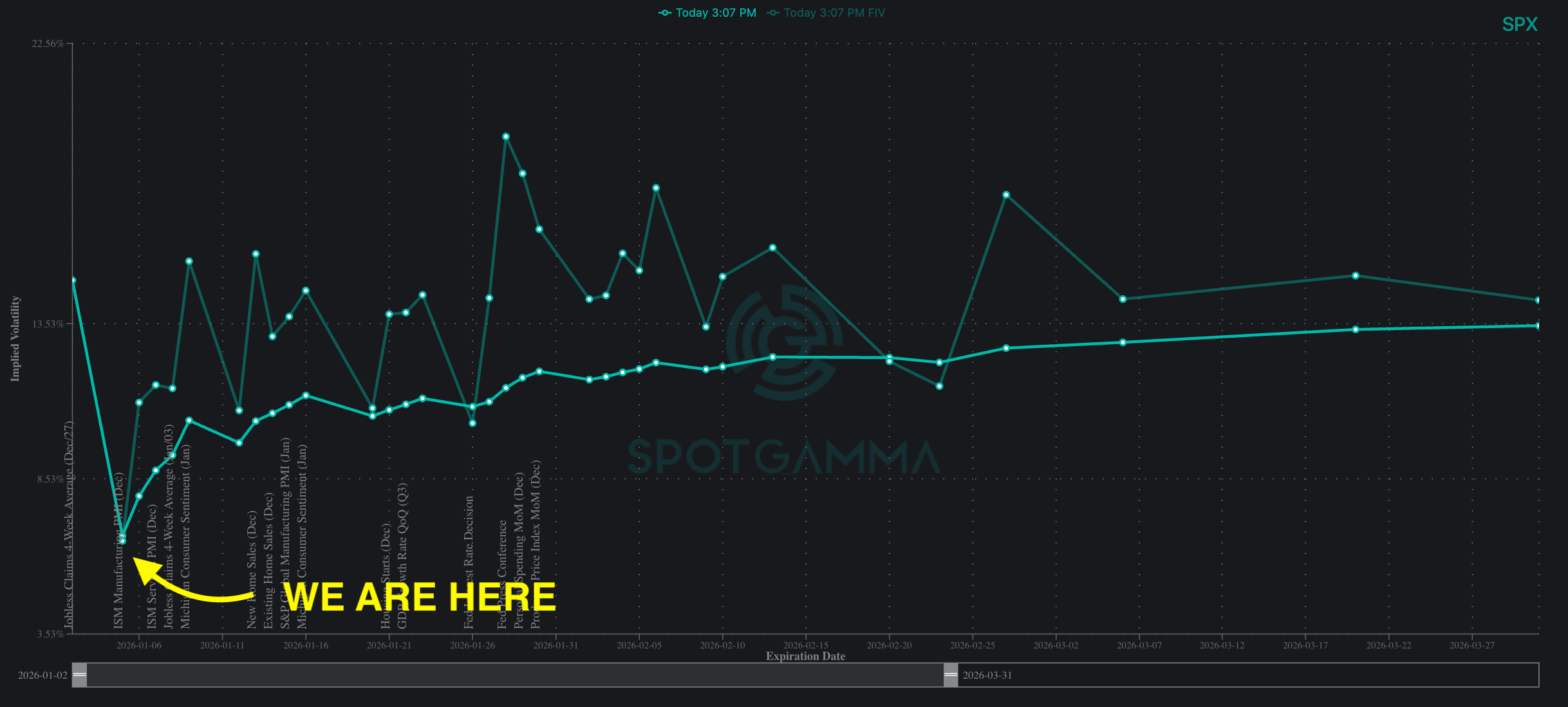

As traders return from the holidays and liquidity normalizes, we would not be surprised if realized moves begin to expand meaningfully. Notably, Forward Implied Volatility within the Term Structure remains elevated relative to spot IV, signaling the potential for volatility expansion as holiday effects roll off. This is a key dynamic to monitor heading into the coming week.

Furthermore, the tailwinds following December OPEX have now faded with realized volatility now already near cycle lows: 5-day realized vol sits at just 5.6%, while 1-month realized vol is at 8.8%. If anything, January has begun with a volatility headwind.

The first full trading week of 2025 also brings a handful of catalysts for traders to watch for, as economic anxiety remains:

- 1/5: ISM Manufacturing

- 1/6: Services PMI

- 1/7: ISM Non-Manufacturing/JOLTS

- 1/8: Initial Jobless Claims

- 1/9: Non-Farm Payrolls

As volatility now appears poised to wake up, traders seem to be preparing for another active year. We are reminder of a fitting quote from The Psychology of Money by Morgan Housel:

“The wisdom in having room for error is acknowledging that uncertainty, randomness, and chance—‘unknowns’—are an ever-present part of life. The only way to deal with them is by increasing the gap between what you think will happen and what can happen while still leaving you capable of fighting another day.”