ES Futures moved sharply lower overnight on 2/12-2/13 as fears of the Coronavirus moved higher. This created selling pressure which went unchecked until markets hit the key 3350 level. Its at this level which we measured the highest level of “Absolute Gamma” which the absolute value of call gamma + put gamma. We also calculated […]

market selloff

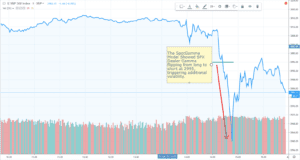

Fed Day Market Move from a Gamma Perspective

Equity markets had an incredibly volatile day on 7/31/19 triggered by actions of the Federal Reserve. Its our view that the moves were exacerbated by the positioning of dealers in S&P 500 options. A quick wave of selling entered the markets just above 3000, pushing the market under our “volatility trigger” level of 2995. At […]