Strong 0DTE Support Lifts the Market to Record Highs

The S&P 500 kicked off 2026 by grinding through a week of macro data releases to finish at fresh all-time highs on Friday. SPX closed at 6,966, up from the 6,902 open on Monday, after finding critical support in the 6,890–6,900 zone multiple times throughout the week.

The week was defined by positive gamma positioning in the 6,900–7,000 range, which kept price action largely contained to support a grinding, low-volatility advance. As we discussed in last week’s newsletter, 0DTE options sellers were the source of this consistent positive gamma, with intraday put selling dominating most sessions.

In Monday’s pre-market Founder’s Note, we first explored SPX 7,000 calls expiring on January 16. This contract delivered a 70% return by Tuesday, with a return of 110% as measured on Friday.

Given record highs, we have been watching vols closely. By Friday’s close, SPX implied volatility had fallen significantly: our Volatility Dashboard recorded ~5% IV for at-the-money options expiring Monday, with sub-10% IV through next week. Traders appear reluctant to pay risk premium heading into OPEX week, making these options appear relatively inexpensive.

Traders Turn to Calls on Oil Stocks

As sector rotation drove some names to outperform this past week, oil-related stocks and ETFs caught our attention. Despite a sharp fade following Monday’s gap higher, dips were actively bought and these stocks have reversed back higher.

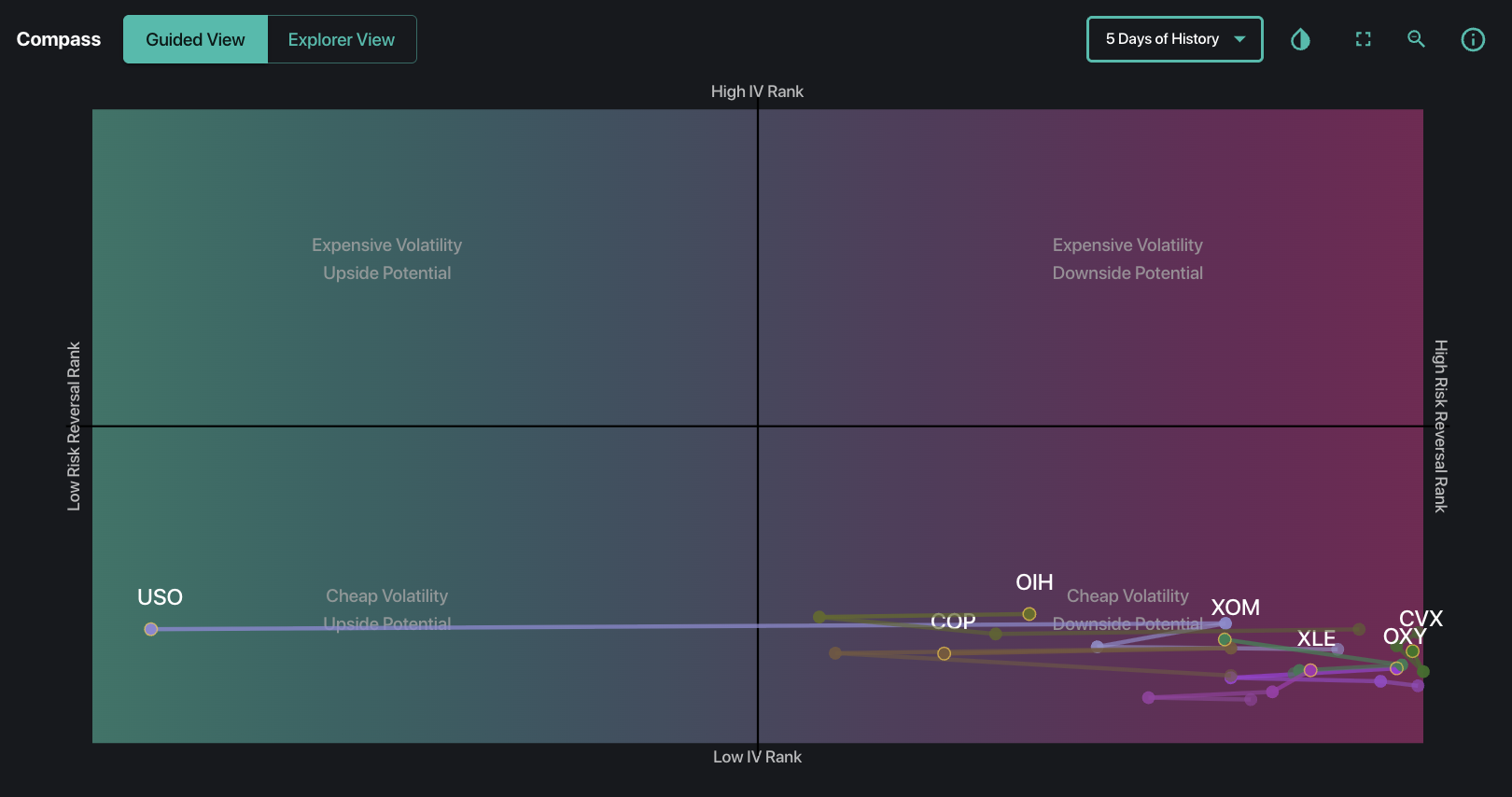

Using our Compass tool, we can see that most oil stocks now sit in the lower-right quadrant, indicating call-heavy positioning. Traders have bid up calls in names such as CVX, OXY, XOM, COP along with energy ETFs like XLE and OIH. Meanwhile, the oil ETF USO remains singularly skewed toward puts.

This divergence is interesting, and pricing of these options suggests traders view the Venezuela headlines as more bullish for individual oil companies than for crude itself. Notably, many oil names also show negative dealer gamma ahead, pointing to longer-dated call accumulation from traders.

We first flagged bullish flow in OXY in the 12/30 FlowPatrol report, including 15k contracts of January 16 calls at the 42 strike, and 30k contracts of January 16 calls at the 43 strike. Reviewing the stock’s open interest, those positions appear largely intact despite OXY rallying roughly 4% this week, with these calls now in-the-money. We’ll be monitoring HIRO and Tape in the coming weeks for valuable intraday updates from the options market as this setup develops further.

The Week Ahead: OPEX, Earnings, and Data Prints

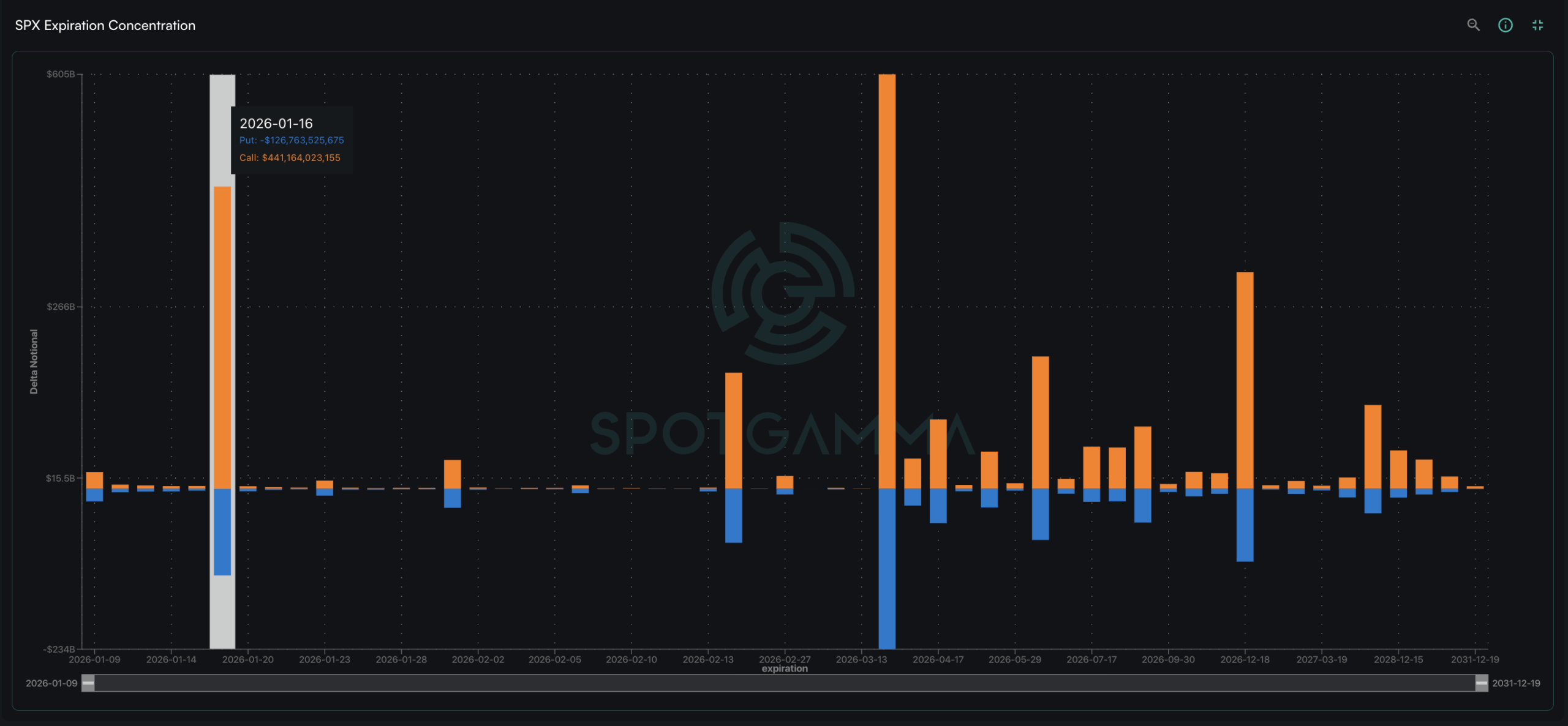

The upcoming week is loaded with potential market-moving events, but traders are showing limited demand for short-dated downside protection despite CPI (1/13), PPI (1/14), bank earnings, and OPEX (1/16) all on deck.

The main event is Friday’s January OPEX, which carries significant implications given the substantial open interest built up at the SPX 7,000 strike. OPEX pinning risk and the subsequent gamma unwind could finally unleash the move that’s been coiled beneath the surface, with this expiration heavily weighted towards calls.

With COR1M at extreme lows and sub-10% implied volatility through most of next week, the asymmetry into OPEX seems to favor owning optionality. We’ll be monitoring January’s expiration throughout the week in our Founder’s Notes for subscribers, as well as our monthly OPEX live take this Wednesday at 1pm ET.