Traders Turn Defensive In the Face of Market’s Climb

SPX tested fresh all-time highs last week, with positive gamma providing guardrails for the broader market. In the face of headline noise—from criminal investigations into Powell to Iran-related escalation—the market absorbed every dip, with the 6,890 Risk Pivot level from Monday’s AM Founder’s Note holding firm. However, increasing put skew and growing volatility premiums indicate traders are starting to brace for downside volatility in the face of the market’s climb.

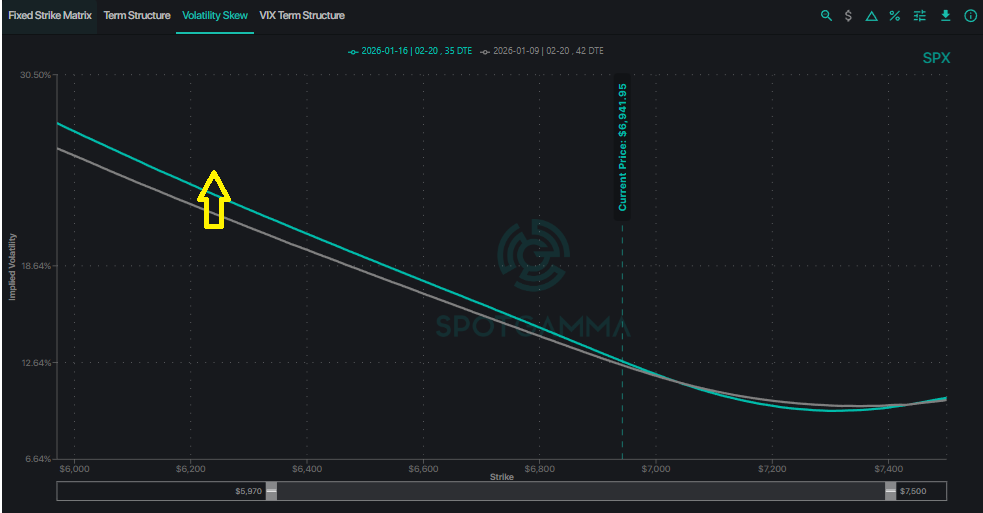

Volatility skew shows us that defensive positioning has begun building: as SPX approached 7,000 this past week, traders began heavily selling 0DTE calls and buying longer-dated puts. This pattern suggests large players are reducing exposure rather than pressing bullish bets amidst market strength.

Overall, S&P 500 gamma exposure remains modestly positive across the nearby price range, suggesting a supportive environment where dealers buy dips and sell rallies. We encourage traders to watch for changes in this put-buying or call-selling behavior, which would disrupt the current gamma regime.

Volatility Premium: Growing Gap Between VIX and Realized Vol

Activity within the VIX complex reveals a similar pattern of growing hedging demand. The VIX has risen to 16, yet realized volatility remains suppressed with one-month realized vol at 9%. This discrepancy is more than double the VIX average of 3.5pts over realized volatility. The expanding vol premium reflects growing uncertainty, and call spreads in the VIX complex have seen notable premium flow. This all points to growing expectations of volatility expansion within the broader market.

Looking at dealer gamma for VIX, there is local positive gamma in 14.5-15.5 zone (green box), and large overall negative gamma from 16 to 22 (red box). From a dealer hedging perspective, a move above 16 could lead to squeeze conditions, which would add fuel to any spike in volatility. These conditions are worth monitoring as we head into the next VIX expiration on January 21.

On the topic of volatility spikes, last Monday we flagged that the CBOE COR1M index declined below critical threshold levels. This serves as a barometer of market exuberance and positioning extremes, as the COR1M measures the relationship between single-stock and index volatility. While the COR1M eventually reversed higher without a meaningful vol shock, our February SPY 690 puts delivered over 50% gains between January 12-14 as volatility increased to start the week.

January FOMC: What Does the Options Market Tell Us?

The upcoming Federal Reserve decision on January 28 adds another layer of event risk, contributing to the elevated IV Term Structure. Market participants seem to be hedging for potential downside, given that rate cut odds are at just 5% according to the CME Fed Watch tool.

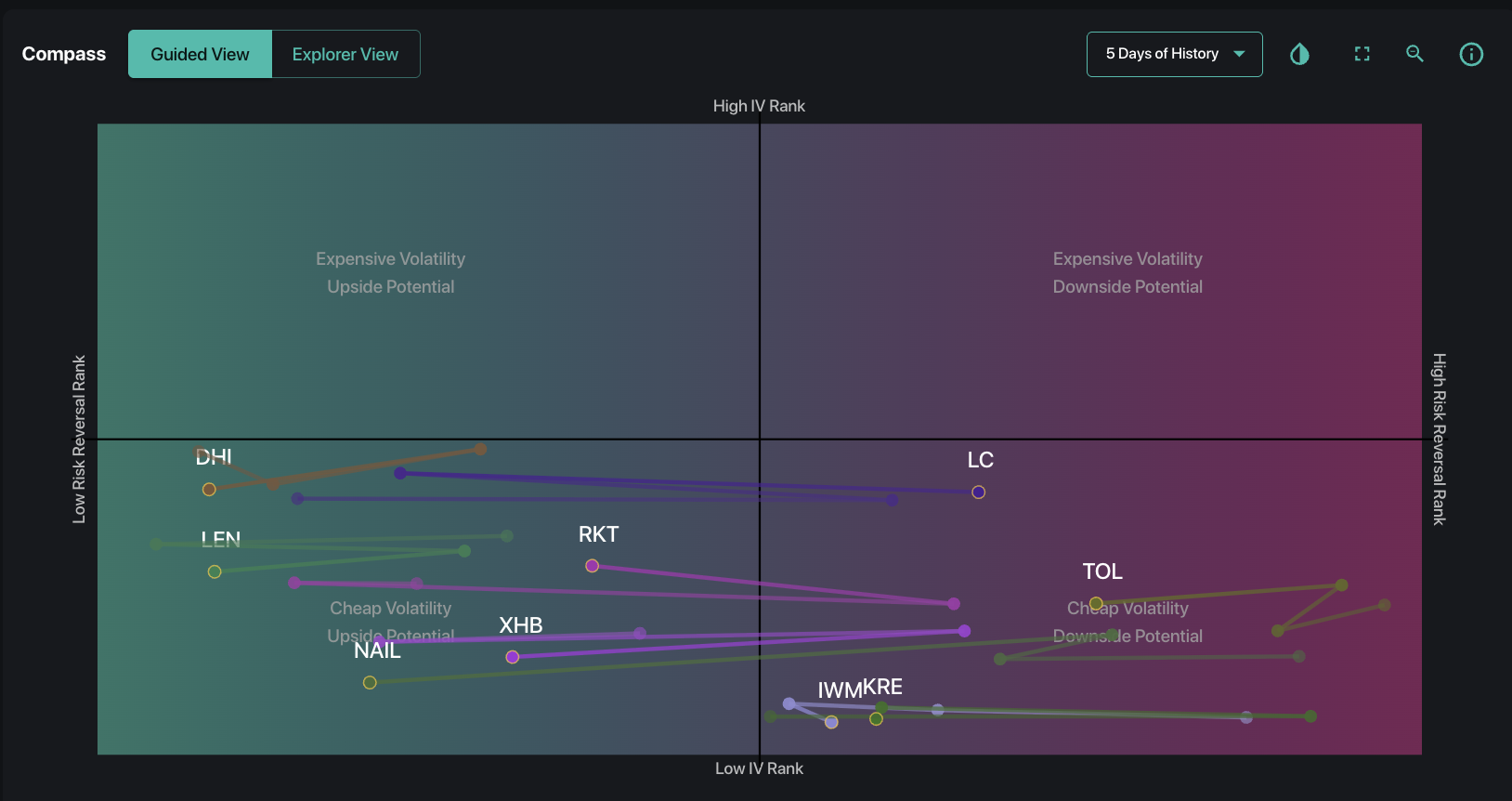

In our Compass tool we can see that many rate sensitive names fall in the lower left quadrant, suggesting more relative put skew vs. call skew. Over the past 5 trading sessions, these tickers have shifted from right to left, indicating increased hedging activity as call skew decreases and/or put skew rises.

Looking at the Term Structure for IWM specifically, ATM Implied Volatility for January 28 is just 18%, while Forward IV sits is 33%. This 15% spread suggests the potential for a IWM vol spike around FOMC, with large movement not yet priced in. IWM’s gamma positioning currently flashes negative gamma across the board, meaning there is potential for meaningful volatility in the name surrounding FOMC.

The Week Ahead: What We’re Watching

The January 2025 post-OPEX environment presents a unique inflection point. While major indices achieve all-time highs and surface-level gamma appears supportive, volatiltiy premiums have grown and traders are turning to puts for downside protection.

Given these conditions, there are several data prints and earnings events to watch for over the following week:

- Mon 1/19: DHI, MMM earnings

- Tue 1/20: NFLX, IBKR earnings

- Wed 1/21: VIX Expiration

- Thu 1/22: GDP, PCE data release

SPX upside appears increasingly capped until we clear FOMC (1/28), or until positive earnings catalysts reignite upward movement. Forward implied vol remains elevated above spot vol, signaling traders expect turbulence through these events.

As always, we want to remind our community that options positioning provides a probabilistic framework, rather than deterministic predictions. Set clear risk levels, respect price action, and adjust positioning as the market reveals its hand.