Last week began with quiet anticipation of Wednesday’s FOMC. When the Fed announced the 25 basis point rate cut and Treasury bill purchases, the reaction was immediate. Equities surged, with the SPX breaking out above our 6,845 Volatility Trigger to approach all-time-highs near the 6,900 resistance level.

The options market had priced in meaningful event-related volatility surrounding FOMC, and that vol was released by Thursday morning. Implied volatility compressed sharply across virtually all strikes and expirations for the S&P 500, creating a favorable tailwind for the broader market.

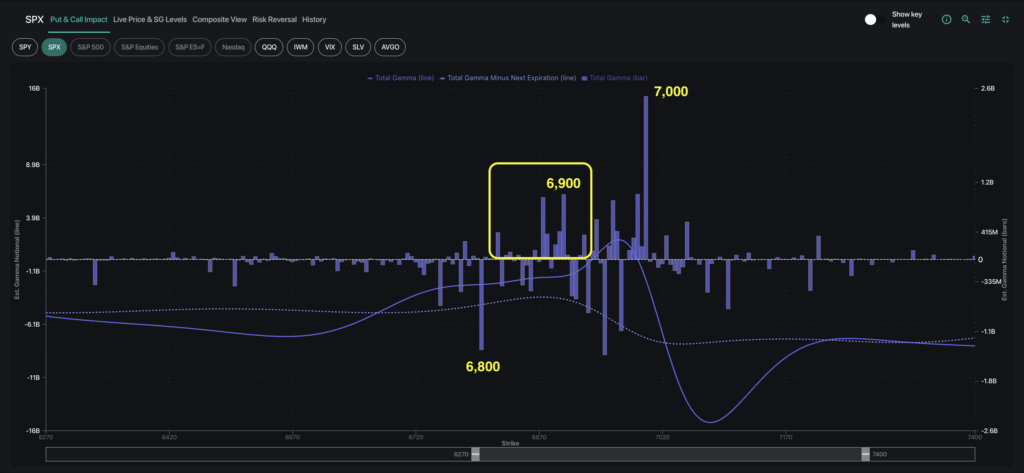

While open-to-close price action remained largely muted throughout much of the week, we observed that the dealer gamma profile between SPX 6,800 and 6,900 was highly concentrated in 0DTE positions. While the overall trend was bullish, the dominance of 0DTE-driven positive gamma created relatively unstable intraday conditions featuring several “shake-out” moves that ended up reversing in short order.

Small Caps Lead Market Rally as Tech Stumbles

Later in the week, the market sent seemingly contradictory signals as IWM broke out to new highs while QQQ lagged. Rather than signaling a move out of equities, this divergence pointed to sector rotation, which is often a healthy feature of bullish markets and supports continued upside.

Small caps benefited directly from this shift. In Tuesday’s AM Founder’s Note, we highlighted 1-month IWM calls that have since gained more than 50% as IWM pushed to fresh all-time highs. The strength in small caps indicate that market leadership may be broadening beyond a handful of mega-cap tech stocks, and this dynamic may serve as a constructive backdrop for a potential Santa Claus rally driven by rotation into value and cyclicals.

Technology earnings delivered a reality check late in the week. Oracle’s revenue miss and elevated cloud CapEx sparked a 12% selloff, followed by an 11% decline from Broadcom, raising questions around the AI narrative. Despite these pressures, the S&P 500 remained resilient, holding above key 6,800 support.

Silver Shines: SLV’s Parabolic Move

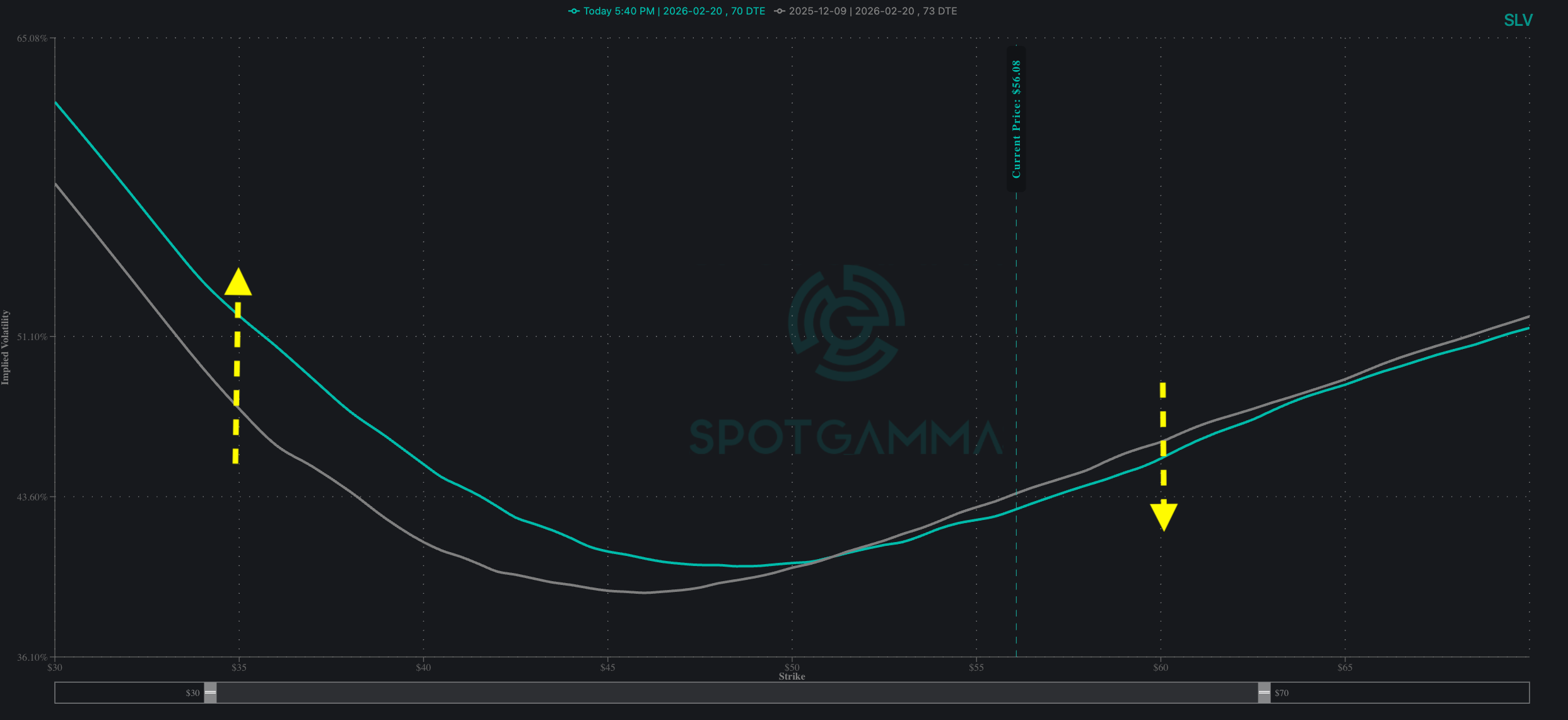

The demand for silver has been significant, with the underlying up 6% for the week and 107% year-to-date. Upside volatility was bid quite high ahead of FOMC, with SLV call skew at the 78th percentile. However, between Wednesday and Friday we observed that put skew rose meaningfully as well, rising to the 67th percentile.

For mean reversion traders, it makes sense that silver might pull back and consolidate somewhat after the epic run. In a ‘spot down, vol down’ scenario, a put spread play could be of interest to offset the volatility crush. As an example for illustrative purposes, the SLV Feb 45/50 put spread shown below showed around a 1-to-4 risk-reward ratio as of Friday afternoon.

The Week Ahead: VIX Expiration, OPEX, and Macro Data

We are entering the last full trading week of 2025 with several notable events to watch:

- 12/16: NFP

- 12/17 VIX Expiration

- 12/18: CPI, MU/FDX/NKE Earnings

- 12/19: OPEX

Our base case remains constructively biased heading into year-end. SPX IV contraction post FOMC is real—further compression toward 10% IVs is plausible as we approach the holiday.

Downside risks cannot be ignored, but they appear to be contained. A break below 6,800 would flip the gamma picture materially negative and likely accelerate a move toward 6,700-6,600 into Friday’s expiration. However, OPEX (12/19) meaningfully clears much of the positioning with over $1 trillion in delta notional expiring. Combined with holiday time decay, sustained downside appears unlikely. Should weakness emerge, traders may look to monetize puts quickly.

The key level to watch remains SPX 6,800. Should that level be maintained this week, the path to 7,000 opens. For options traders, the sub-10% IV environment on calls is unlikely to persist, meaning that any weakness in the next two weeks serves as a potential entry points for longer-dated upside structures.