Options flows blocking a market breakout Monday January 01 1999 Try SpotGamma HIRO Indicator for Free Real-time options data See when options drive stocks 0DTE filter for short-term trades Get Started Free Subscribe to the industry’s #1 platform delivering daily expert analysis to unveil: Proprietary market levels Bullish or bearish stocks Hidden trading risks Get […]

0DTE

Volmageddon? No; JPM, BofA Say 0-DTE Options Are Suppressing Intraday Vol

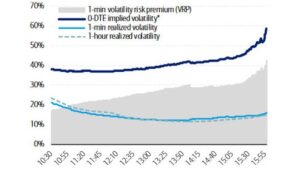

by Tyler Durden of ZeroHedge Tuesday, May 16, 2023 – 03:05 PM In February, JPMorgan’s Marko Kolanovic dropped his now infamous warning that 0-DTE options trading will lead to Volmageddon 2.0 : “these options are net sold by directional investors, and supply of gamma is likely causing a suppression of realized intraday volatility… if there […]

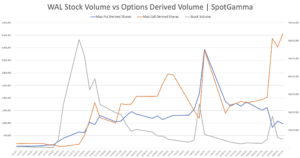

Western Alliance’s CFO Claims Puts Dropped Their Stock – That’s Doubtful

The link between options flow and the underlying shares is based on the concept that options dealers and market makers buy and sell shares of underlying stock to hedge option positions. These hedging requirements are generally measured through Delta (the number of shares required to hedge an option from the directional move of the underlying) […]

SpotGamma on NinjaTrader TV: Why Futures Traders Need to Watch Options Flow

Brent Kochuba, Founder of SpotGamma, talks with NinjaTrader about how significant options flows can drive underlying market prices. This is fantastic talk for futures traders that are new to the idea of options flows in the ES e-mini futures. Topics discussed include: OPEX cycles, gamma hedging & zero DTE options trading.

The Impact of Zero DTE Options Trading

SpotGamma Founder, Brent Kochuba, combines proprietary research with investment bank insights to lay out the impacts of 0DTE to the S&P500.

How 0DTE (Short-Dated) Put Buyers Can Lead the Market Lower

0DTE Options trading continues to capture the attention of traders, as it appears to drive market behavior. Consider this quote from SpotGamma Founder Brent Kochuba, in a recent 0DTE Bloomberg article: “To Brent Kochuba, founder of SpotGamma, the explosive rise of 0DTE options has actually acted as a positive market force. He conducted a study […]

Is The Market Under Control of 0DTE Options Flow?

Through SpotGamma’s unique HIRO real-time options flow tool, we have been documenting the impact of 0DTE short dated options flow. This action is clearly laid out in the video below from Thursday, February 23rd: This quote from BOFA’s recent research piece on 0DTE short dated options flow tells us that its actually 0DTE buyers in […]

No, 0DTE Will Not Result In “Volmageddon:” BofA Derivative Gurus Respond To Kolanovic

0DTE is not Volmageddon 0DTE is likely not Volmageddon per BOFA, and for that to happen you would need a major 0DTE flow imbalance. This is exactly what SpotGamma laid out to members on our Feb 2nd Q&A, here. Courtesy of ZeroHedge Wednesday, Feb 22, 2023 – 05:25 PM One week ago, JPMorgan’s Marko Kolanovic, […]

SpotGamma on Piper Sandler “Options Roundtable” Podcast

Brent Kochuba, Founder of SpotGamma, joined Piper’s Head of Options Trading Danny Kirsch to talk about 0DTE, and the options volatility space. Listen to the audio, here.

A Link Between 0DTE & Treasury Auctions?

SpotGamma recently began investigating a link between 0DTE options volumes and treasury auctions. The first research was posted in our Founder’s Note, and picked up by ZeroHedge: From ZeroHedge: Bonds and stocks were nicely correlated after the US cash open and traded in sync before decoupling around the European close… However, zooming in on the […]