The following is a guest post from Doug Pless. As I have discussed in previous articles, I begin my morning preparation by reading the AM Founder’s Note when I plan to trade futures. For ES futures, I note gamma levels, the SpotGamma Imp. 1 Day Move, the SpotGamma Gamma Index, and Gamma Notional for SPX […]

ES futures

Trade Analysis: ES Futures (13 September 2021)

The following is a guest post from Doug Pless. As I have discussed in previous articles, I begin my morning preparation by reading the SpotGamma AM Report when I plan to trade futures. For ES futures, I note gamma levels, the SpotGamma Imp. 1 Day Move, the SpotGamma Gamma Index, and Gamma Notional for SPX […]

Trading ES Futures Using HIRO and Vanna

The following is a guest post from Doug Pless. As I have discussed in previous articles, I begin my morning preparation by gathering information to help develop a thesis for the day when I trade futures. My thesis includes the following items: Directional bias Anticipated volatility Trading range for the day My primary sources of […]

Trading ES Futures Using HIRO

The following is a guest post from Doug Pless. When I trade futures, I begin my morning preparation by gathering information to help develop a thesis for the day. My thesis includes the following items: Directional bias Anticipated volatility Trading range for the day My primary source of information is the SpotGamma AM Report. For […]

Trading ES Futures Using SpotGamma Levels and Vanna Model

The following is a guest post from Doug Pless. As I discussed previously, I begin my morning preparation by reading the SpotGamma AM Report when I plan to trade futures. For ES futures, I note gamma levels, the SpotGamma Index, and Gamma Notional for SPX and SPY. The SpotGamma Gamma Index is a proprietary measurement […]

Repeatable Setups in ES Futures Using SpotGamma Levels

The following is a guest post from Doug Pless. As discussed previously in my approach to trading futures with SpotGamma, I begin my morning preparation by reading the SpotGamma AM Report when I plan to trade ES futures. This report provides key metrics as well as updated gamma levels including the Volatility Trigger, Zero Gamma, […]

Trader David Blake & ES “Unicorn Levels”

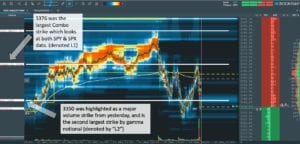

This post is courtesy of David Blake, a full time trader from the UK. He can be reached on Twitter. I always have loved the London open and that harks back to my forex trading days. ETH (extended trading hours) often has a simpler rhythm to it, keep an eye of what the European markets […]

Options Action around a Wild Wednesday

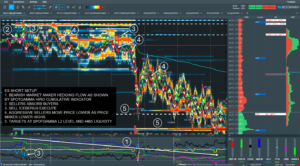

The market was wild today with ES futures having moved almost 90 points from the overnight lows. Negative news about stimulus and vaccines halted the risk and the market broke sharply down to the key 3350 area. You can see below on the chart exactly how our two major levels fit into todays action.

ES Futures 9/22/20

ES futures bounce off of our 3267 low and close right on the ZeroGamma level. Our levels are noted at left in the “Gamma” column. This is the Bookmap trading system.

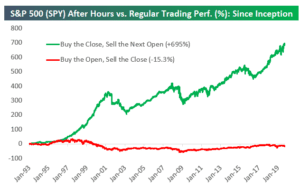

Overnight Outperforms?

There is well knows research which shows that the overnight session in ES/SPX is the source of most of the positive market performance. This chart from Bespoke does a great job highlighting this. We have thought a lot about this, and had a theory that this out-performance may be due in part to options hedging […]