The following is a guest post from Doug Pless. Preparation When I plan to trade futures, I begin my morning preparation by reading the SpotGamma AM Founder’s Note. For ES futures, I note key Gamma levels for SPX and SPY, the SpotGamma Imp. 1 Day Move for SPX, the SpotGamma Gamma Index and Gamma Notional […]

Equity Hub

Trade Analysis: NVDA (July 20, 2022)

The following is a guest post from Doug Pless. When I plan to trade stocks for the day, I begin my morning preparation by opening my watchlist in Equity Hub. I look at the Key Gamma Strike, Hedge Wall, Key Delta Strike, and other metrics for each stock and compare the values with the previous […]

Trade Analysis: TSLA (June 17, 2022)

The following is a guest post from Doug Pless. When I plan to trade stocks for the day, I begin my morning preparation by opening my watchlist in Equity Hub. I look at the Key Gamma Strike, Hedge Wall, Key Delta Strike, and other metrics for each stock and compare the values with the previous […]

Trade Analysis: AMD (May 26, 2022)

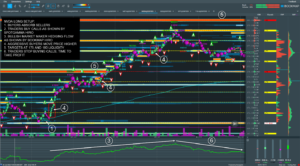

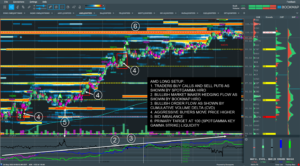

The following is a guest post from Doug Pless. When I plan to trade stocks for the day, I begin my morning preparation by opening my watchlist in Equity Hub. I look at the Key Gamma Strike, Hedge Wall, and other metrics and compare the values with the previous values for the last five days. […]

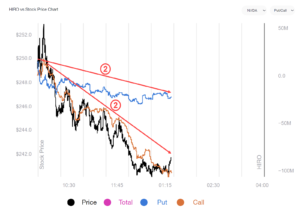

Trading Stock Using Equity Hub and HIRO

The following is a guest post from Doug Pless. When I plan to trade stocks for the day, I begin my morning preparation by opening my watchlist in Equity Hub. I look at the Key Gamma Strike, Hedge Wall, and other metrics and compare the values with the previous values for the last five days. […]

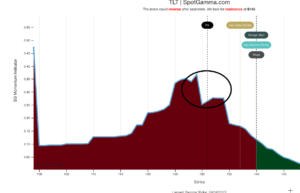

The TLT’s Recent Plunge May Be Over

The following is a guest post courtesy of Michael Kramer of Mott Capital Management. Bond yields have soared in 2022, sending ETFs like the iShares 20+ Year Treasury Bond ETF (TLT) lower by around 10%, but almost 25% off its 2020 highs. The ETF now comes to a critical juncture, signaling rates pushing significantly higher […]

The Sell-off For The NASDAQ May Not Be Over Yet

The following is a guest post courtesy of Michael Kramer of Mott Capital Management. With the Fed pivoting to a very hawkish stance starting in 2022, the Nasdaq has witnessed a dramatic decline of nearly 18% since peaking in November. The drop may only continue in the weeks ahead as market participants try to figure out the potential […]

Trade Analysis: ES Futures (7 February 2022)

The following is a guest post from Doug Pless. When I plan to trade futures, I begin my morning preparation by reading the SpotGamma AM Founder’s Note. For ES futures, I note gamma levels, the SpotGamma Imp. 1 Day Move, the SpotGamma Gamma Index, and Gamma Notional for SPX and SPY. I also look up […]

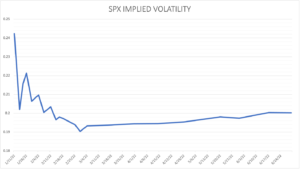

Next Week’s Fed Meeting May Create Massive Moves In The Market

The following is a guest post courtesy of Michael Kramer of Mott Capital Management. Stock market volatility has picked up, and it may only be starting. Investors are eagerly awaiting the next FOMC meeting on January 26 to try and gauge which way the Fed may choose to go in its fight with inflation. With […]

Trade Analysis: NQ Futures (12 January 2022)

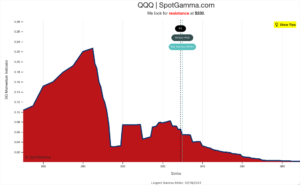

The following is a guest post from Doug Pless. When I plan to trade futures, I begin my morning preparation by reading the SpotGamma AM Founder’s Note. For NQ futures, I note Gamma Notional, and the Volatility Trigger, Put Wall, and Call Wall gamma levels for QQQ. I also look up QQQ in Equity Hub. […]