My view of the past week has been this: The markets slipped into negative gamma on Monday 2/24 under the narrative of Coronavirus fears. As large concentrations of puts went in the money their hedging requirements increased, meaning gamma got more negative as the market moved lower. Once in negative gamma territory options dealers change […]

mcelligott

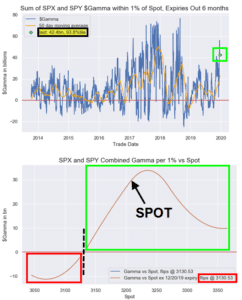

Nomuras Gamma Model 12/23/19

We like to post Nomuras model snapshot here to compare against ours. Our volatility neutral indicator is lower, but the top matches. Some of this may be explained by Nomura combining SPY and SPX.

Nomura’s McElligott Explains The ‘Perfect Virtuous Feedback Loop’ As Gamma Gravity Pins Equities “Intraday movement is squelched”.

From Heisenberg a great note from Nomura which syncs with what we wrote in recent weeks and to our subscribers. “Price movements over this summer once again clearly emphasized the spot/gamma/realized vol dynamics”, SocGen wrote, in a September note documenting a crucial dynamic that can always be described as “underappreciated” until everyone understands it. “All […]

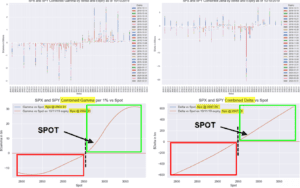

Nomuras Gamma View after the Rally

Via Heisenberg, here is Nomuras Gamma View after the Rally. They note the following: “[The SPX was ]gravitationally pulled higher (spot 2970) and now sits comfortably between the two large $Gamma upside strikes of 3000 ($3.7B) and 2950 ($2.5B)”…“As the bullish macro catalysts have indeed begun materializing, the various hedge expressions (VIX upside, S&P downside, […]

Nomura: Volatility Crush Market Options Gamma on CNBC

Nomura analyst on CNBC discussing how dealer gamma effects the equity market. He mentions the large open interest in the VIX (“50 Cent”) and how a volatility crush could spur an equity rally. This is because (as seen through the SpotGamma model) a drop in volatility forces dealers to rehedge through buying stocks. As the […]