Our current view of markets is that we should see reduced price volatility following the large March expiration that took place this past Friday (3/20). One of the features of this expiration was a large number of in the money puts, which possibly created several billion in deltas for options dealers to hedge. As dealers have to hedge these positions they use ES futures, and with active markets they are pushed to pay the spread to ensure filling their order. This may have been a key driver in the massive price volatility we have been seeing in the SPX and VIX.

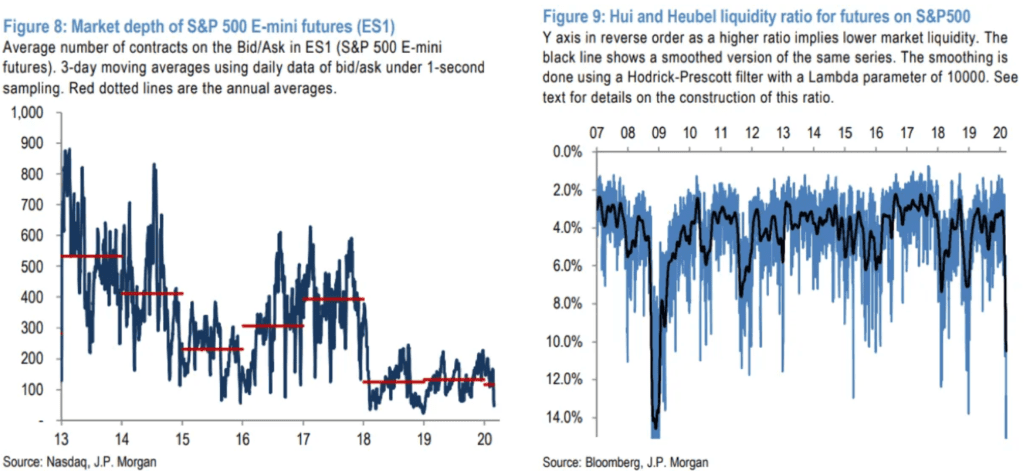

If you note the chart from JPM below of ES futures liquidity (source) you can see that it is lower than even during the ’08/’09 financial crisis. This indicates that there is now increased slippage to fill an order. For example, if you have to fill 1000 contracts today you may have to pay 5 ticks, whereas in February it would have cost 1 tick.

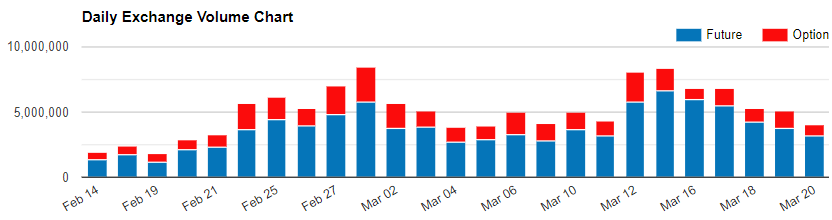

However, futures volumes are high (chart below). What this suggests is that while there is little posted liquidity traders are still active and are having to cross the spread to get their orders filled.

Therefore as options dealers were forced to hedge all these large put deltas over the last several weeks, they have had to pay very high spreads to get their orders off. This may in turn have led to very large price distribution, aka volatility as they have to pay prices further and further away from the top of book.

Because these large options positions have expired it may now lead to less dealer hedging and in turn reduce price volatility.

EDIT:

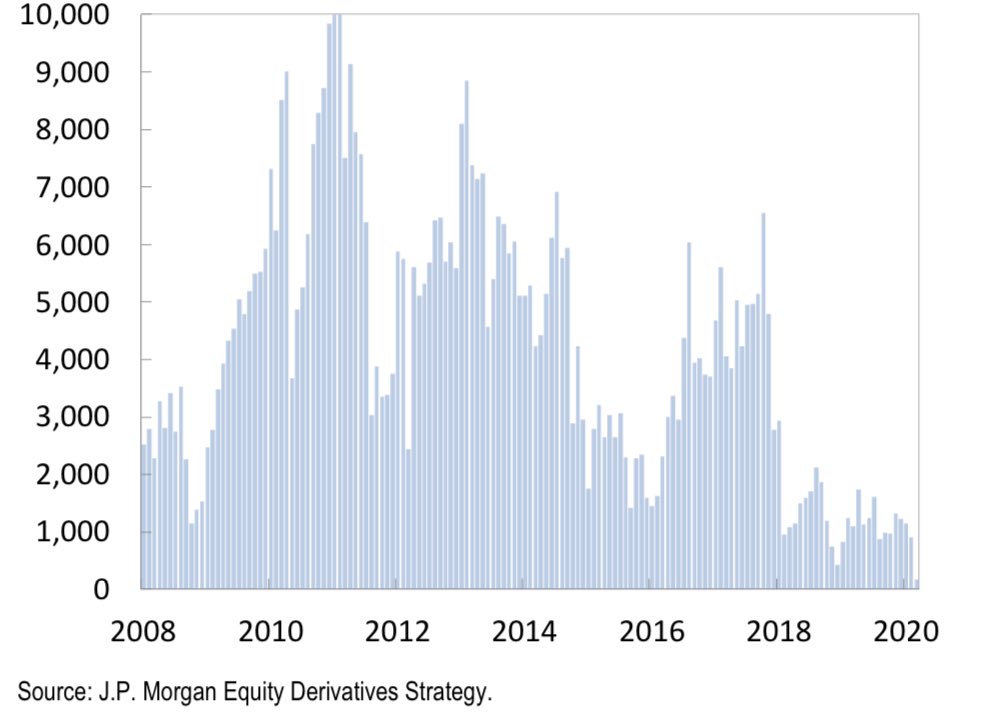

We also came across the following liquidity charts from Heisenberg Report: