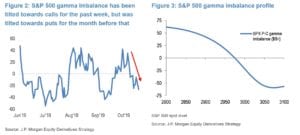

JPM recently put out the following charts on S&P500 Gamma including a ratio of call gamma to put gamma which is quite interesting. It shows the amount of call gamma minus put gamma which could be interpreted in a few different ways. One way would be to look at it as how the market is […]

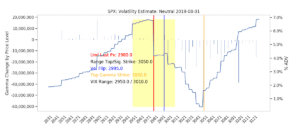

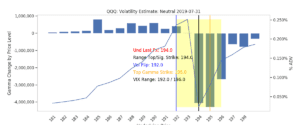

Gamma Model Output

SpotGamma Trading Levels Vs Nomura

Here is a report from Nomura compared to the same days market forecast from SpotGamma.com. Notice the “zero gamma” levels are the same in both reports at 2935 in the S&P500. We call the “zero gamma” level “volatility trigger”. Using this level can help forecast the level of stock market volatility. Under this market price […]