Friday (4/3/20) was an interesting day in the S&P500 market due to its rotating action around the 2500 strike. We had several data points that led us to believe that this strike would be key to the action on Friday and wanted to highlight those points. Most of these charts are only available to subscribers […]

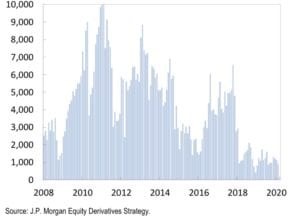

futures volume

The Case for Reduced Price Volatility

Our current view of markets is that we should see reduced price volatility following the large March expiration that took place this past Friday (3/20). One of the features of this expiration was a large number of in the money puts, which possibly created several billion in deltas for options dealers to hedge. As dealers […]