Market Makers & Coronavirus: The Mechanics of a Market Sell-Off How do sell-offs actually happen? With the S&P 500 selling off hard and fast, Hari Krishnan, fund manager at Doherty Advisors, breaks down the mechanics of market meltdowns. Krishnan explains the role of different institutional players like market-makers and drills down on the individual components […]

coronavirus

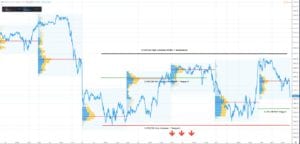

Feb 12 – Absolute Gamma Bounce

ES Futures moved sharply lower overnight on 2/12-2/13 as fears of the Coronavirus moved higher. This created selling pressure which went unchecked until markets hit the key 3350 level. Its at this level which we measured the highest level of “Absolute Gamma” which the absolute value of call gamma + put gamma. We also calculated […]

Somethings Gotta Give – The SPX Box

A quick note, particularly for documentation. Currently (1/31/20) the market awaits a slew of catalysts including: coronavirus updates, Iowa caucuses and the Chinese market reopening. For the last few days we’ve been contained in this fairly volatile range between ~3300 (our high gamma strike) and ~3240 (zero gamma). Above we can bask in the comfort […]

Virus Outbreak – Week in Review

Ahead of important AAPL (Apple) earnings and the FOMC we wanted to review the market over the past week. We have spent a lot of time drawing an analogy between todays market and that of January ’18 (see here). Interestingly the Jan ’18 market topped the same day as the current market. Currently gamma is […]