We ran a detailed analysis of the impact of same day options expiration volume vs open interest and the effect this may have on “pinning” the market into the close. Some may also refer to the idea as “options max pain”. You can read it here but we thought it was worth showing the effect […]

volume

Searching for a Market Bounce: Feb 2020

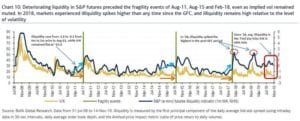

Below are a few charts that we’ve been watching as we’re in the midst of the Crash of Feb 2020. Several indicators are showing extreme readings and we wanted to chronicle those. If you have one you think we should add email us: sg@spotgamma.com. One of the things we look at “Gamma Tilt” which is […]

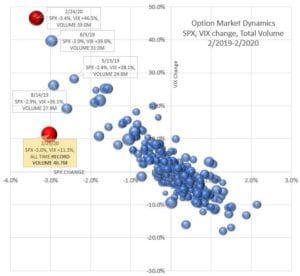

Options Market Gamma Theory is All About Volume

Options market gamma numbers proliferate the market but its important to understand what exactly those numbers mean. Yes, positive gamma may indicate lower stock volatility. And when gamma flips from positive to negative that may indicate higher volatility. But the actual gamma number itself is an estimate of how much stock dealers will have to […]