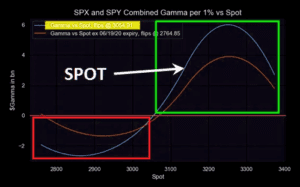

We spend a lot of time talking to our members about the lack of structure in the SPX options market. What we mean is the positioning in SPX options is just very small as seen in this chart below which maps total SPX call & put gamma. This has implications for markets not just at […]

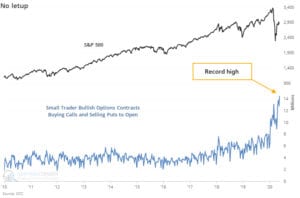

sentimenttrader

Attack of Risk Reversal

@SentimentTrader posted this chart showing record “small” positions in long calls and short puts. Sentiment says these are “10 contracts or fewer per trade”, insinuating retail traders. This type of trade (long call/short put) is a position also known as a risk reversal. While the traders are not likely actually trading short puts and long […]