The following is a guest post from Doug Pless. As I discussed previously, I begin my morning preparation by reading the SpotGamma AM Report when I plan to trade futures. For ES futures, I note gamma levels, the SpotGamma Index, and Gamma Notional for SPX and SPY. The SpotGamma Gamma Index is a proprietary measurement […]

Market Analysis

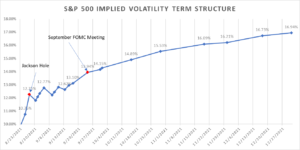

Volatility In The Markets May Rise Dramatically As Jackson Hole Approaches

The following is a guest post courtesy of Michael Kramer of Mott Capital Management. Jay Powell will speak at next week’s Jackson Hole Economic Symposium. Some investors think it may be where he lays out the Fed’s path towards the tapering of asset purchases. Recent economic data suggests that inflation is running at levels that […]

Trading NQ Futures Using QQQ Equity Hub Data and Vanna Model

The following is a guest post from Doug Pless. As discussed previously, I begin my morning preparation by reading the SpotGamma AM Report when I plan to trade futures. For ES futures, I note gamma levels and key metrics for SPX and SPY. For NQ futures, I note Gamma Notional, and the Volatility Trigger, Put […]

Repeatable Setups in ES Futures Using SpotGamma Levels

The following is a guest post from Doug Pless. As discussed previously in my approach to trading futures with SpotGamma, I begin my morning preparation by reading the SpotGamma AM Report when I plan to trade ES futures. This report provides key metrics as well as updated gamma levels including the Volatility Trigger, Zero Gamma, […]

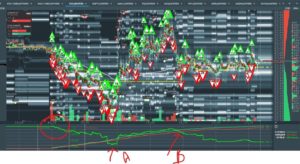

SpotGamma Levels Backed Up by Live HIRO Indicator Signals Can Add Confidence to Trading Decisions

This is a guest post from professional trader David Blake. As some of you know I’m a user of BloodHound by SharkIndicators to drive racing stripes on my NinjaTrader Charts, and a logic I frequently use from ZoneTraderPro has VXX coded within it among other dark arts. Following the Market Action: August 8, 2021 I […]

SpotGamma Levels as Part of a Setup and Trade Management Plan for NQ

This is a guest post from professional trader David Blake. Greetings to those of you that see my regular posts on Twitter (@tarantinotradi1) and Slack where I post my trade thoughts related to price action moves. As the week moves towards NFP Friday, it’s been a tight day so far, and I want to share […]

RobinHood (HOOD) Gamma Squeeze

Robinhood’s recent IPO was initially lackluster, with the stock trading down ~7% from its IPO price. In recent days the stock then started to catch a bid as Cathie Wood & ARK bought in. However yesterday HOOD stock launched over 50%…but why? Options. Options Trading Now Available in HOOD Yesterday was the first day that […]

SpotGamma on DeepDive CA

SpotGamma had the pleasure of being on DeepDive with Steve and Jay. We talked about meme stocks, dark pools and naked shorting.

Trading Stock Using Equity Hub and Dark Pool Indicator

The following is a guest post from Doug Pless. As I have discussed previously, my stock trading strategy is to look for long positions in stocks with actively traded options early in the week. Many traders open bullish option positions early in the week with short-term options that expire at the end of week. As […]

Friday YouTube Live

4400 pinning despite FED, China, AMZN et al Intraday volatility & vanna charts Markets into Sep: contango, Aug vs Sep vol Playing AMZN