Here we show how EquityHub plots out gamma curves, which could be used to find areas of support or resistance during extreme volatility. In this case WMT declined 10% after earnings – a price move which brought the stock to a “zero gamma” zone. This indicated that options market maker hedging may tail sharply off, […]

Stock

The Setup for a Gamma Squeeze in GME

Here we identify the options setup needed for a gamma squeeze in a stock like GME. Using our EquityHub we analyze the existing options position, and then look for signs of strong live options orderflow via our HIRO application. Specifically, you want to see large open interest at call strikes just above where a stock […]

GME Pinning Options Levels After a Huge Rally

On Friday Brent was joined by Saad from ShiftSearch to analyze the >20% rally in GME last week. They discussed why GME was ripe for a pullback, and why $120 was the big level of support for today, Tuesday May 31st. Below you can see how that $120 level has acted as major support today. […]

Barclays Suspends VXX & OIL Issuance

Because of this OIL/VXX may start trading significantly above their asset based IV price. Likely will become very difficult to short these products & without shares to short Authorized Participants can’t do arbitrage operations they typical run to drive price down to IV Price. https://t.co/1lacpxhnVf — Vance Harwood (@6_Figure_Invest) March 14, 2022 From BusinessWire: Barclays […]

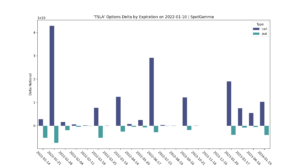

January OPEX: TSLA Tracking

SpotGamma has detected a large amount of call options expiring this Friday in many single stocks (see here). The stock with the largest size (on a delta basis) expiring is TSLA. As such, we’ve setup this page to track the daily change in TSLA’s delta position, to monitor what any options impact may be. In […]

Elon Sells. Tesla Rallies. What’s Up With That?

The News: After registering to sell shares, over the weekend, Tesla (TSLA) Inc CEO Elon Musk polled Twitter on whether to follow through. His followers voted “Yes” to him selling 10% of its stake. The Sale Process: While we are not provided the timestamps linked to the execution, you can extrapolate the timing by reviewing […]

SpotGamma TDAmeritrade Appearance

Tesla (TSLA) Stock Hit All-Time Highs, Options Volume & Open Interest What can the Tesla (TSLA) options volume and open interest tell investors about its stock price moving forward? Brent Kochuba says that TSLA is the reverse of PTON as the stock keeps moving higher. Some of the recent trading trends include more options activity […]

To Infinity And Beyond: Shares Of Social Media Favorite Tesla Fly On Robust Options Activity

by Renato Leonard Capelj “I’ve actually never seen a stock go up endlessly on nothing.” That’s according to CNBC’s Jim Cramer who commented Monday on Tesla Inc’s (TSLA) near-vertical price rise on the heels of record quarterly revenue and profit, as well as news that Hertz Global Holdings Inc (HTZZ), a rental car company that […]

SpotGamma on Dave Lee Show: TSLA

What’s Next for Tesla Stock? Understanding a Gamma Squeeze

Stocks With Large Options Positions Expiring on 9/17/21

Friday, September 17th is a large Triple Witching expiration which means that many stocks/ETFs/Indicies have large options positions that will be closed at 4pm EST on Friday. At SpotGamma we believe that when large options positions expire it can spark volatility in stocks. Our models estimate over 50% of single stocks have their largest options […]