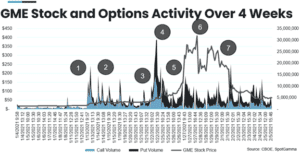

In late January 2021, GameStop experienced a once-in-a-decade squeeze that has captivated the world’s attention. This was a premeditated and programmatic exercise, orchestrated by coordinated stock and option buying across the retail and professional community, that resulted in large institutional entities losing billions of dollars. These investment houses with significant short positions did not expect a stock with […]

delta hedging

When YOLO goes “YOL-Oh No!”

Summary: Issue: SpotGamma believes that current markets reflect a great amount of risk and face the prospect of a violent drawdown. This is due to the following: Hedging: Low levels of options-based hedging. Short-Selling: Low levels of stock shorting. Speculation: High levels of margin used to buy stocks. Remedies: SpotGamma levels continue to be […]

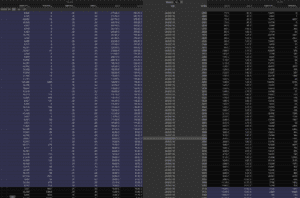

Why Dec ’19’s Large Open Interest Could Cause Volatility

December OPEX has a many strikes that have large open interest (OI). For calls there are many in the money strikes as you can see in the grid below with OI greater than 20k or 40k – the 3000k strike has 125k contracts. There is large size in puts as well, but these are currently […]