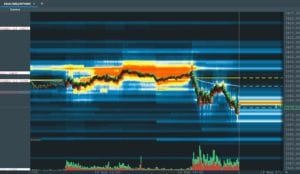

We’ve been marking 3400 as a large gamma area for several days, and you can see from our morning data that the 3400 area was again key today. Our levels are listed above, left in the Bookmap column. You can also see dark red areas in the center of the chart which denotes bid/ask liquidity, […]

futures liquidity

The Case for Reduced Price Volatility

Our current view of markets is that we should see reduced price volatility following the large March expiration that took place this past Friday (3/20). One of the features of this expiration was a large number of in the money puts, which possibly created several billion in deltas for options dealers to hedge. As dealers […]

Poor Liquidity & Negative Gamma: Volatile Stuff

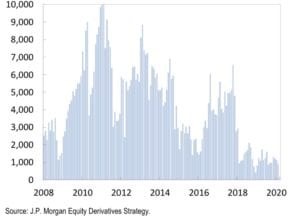

We’ve written extensively about negative gamma and poor liquidity during volatile markets, and wanted to post some of those effects in real time. ZH posted an article framing how bad liquidity in ES futures is, note the chart below: as the following chart from Deutsche Bank shows, overall liquidity for S&P500 futures has fallen to all […]

JPM Liquidity Rates & VIX Correlation

JPM says that liquidity disappears as VIX spikes. This seems to make intuitive sense. The fact that the VIX is higher means the market is pricing in larger moves which means dealers don’t want to get stuffed with large trades as the market rips through them. This chart doesn’t tell us what level this depth […]