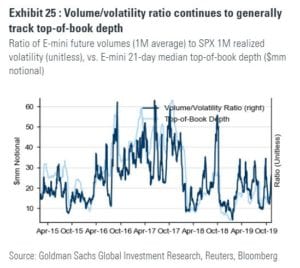

We’ve written extensively about negative gamma and poor liquidity during volatile markets, and wanted to post some of those effects in real time. ZH posted an article framing how bad liquidity in ES futures is, note the chart below: as the following chart from Deutsche Bank shows, overall liquidity for S&P500 futures has fallen to all […]

negative gamma

SpotGamma 2/24/20 AM Report

We’ve moved well through the zero gamma area and are testing the first “put wall” and “absolute gamma strike”. Puts are now in control of gamma which indicates more volatility ahead. I would not look at the put wall as a solid support line, but more of a pivot or “band” around which larger moves […]

Volume vs Dealer Gamma

As volatility spikes S&P E-mini top of book depth decreases. Anecdotally this doesn’t come as a surprise because higher volatility should make dealers reduce size and be less aggressive. Whats interesting is that (in theory) in a negative gamma world options hedgers don’t reduce their size, so they just face less liquidity which means their […]

Options Vanna Rally

Now a prescient time to talk about options Vanna, and a Vanna rally. Vanna measures the change in delta for a change in Implied Volatility. Long calls + short puts = Long Vanna We view options market makers as typically long vanna. When volatility crushes they therefore must buy stock back to reduce their hedges. […]

Gamma Before China Trade Talks

We started the day negative gamma but had a rally to just above the zero gamma level. There appears to be a sizeable market hedge at 2900 which could provide support for the markets. If volatility breaks the put hedges that dealers are holding will act as fuel to spark a strong rally. The 3000 […]

The Theory Behind Put Walls

For this example, 2900 in the S&P500 is identified as a strike with large put interest in SPX options. The theory behind Put Walls: We make an assumption that most of those puts were bought by hedgers, therefore market makers and dealers are short those 2900 puts. As a result they must short sell stock […]

October’s Negative Gamma

Here is a brief summary of the October Negative Gamma move so far. On 9/30 around the 3000 level in SPX we calculated a long gamma position for the market, but that quickly changed due to a very ugly ISM print. Once the market punched through the 2970 volatility trigger level, dealers fueled the selloff […]

The “Impeachment” Gamma Trap

Going to Tuesday we noted 2970 as the 0 gamma volatility trigger and on Wednesday we pushed below that volatility trigger level indicating we should see some large moves in the SPX. The chart of the past two days in ES futures is here: Here was our gamma run from 9/24: After the close on […]

Negative Gamma in Oil Markets

Bloomberg posts an article about the effects of negative gamma in oil markets. Its full of hyperbole, but portrays the general idea right. Traders frenetically sell futures to manage their options exposure; that drives down prices and brings more options into the danger zone; dealers are then forced to sell even more crude contracts. This […]