The following is a guest post courtesy of Michael Kramer of Mott Capital Management. The equity markets have had sharp drawdowns and extremely high volatility in 2022. While this dynamic has created a difficult backdrop for traders, the options market is playing a big role during these tricky times and SpotGamma indicators may provide an […]

volatility trigger

Trade Analysis: ES Futures (24 November 2021)

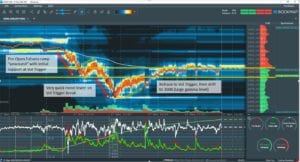

The following is a guest post from Doug Pless. As I have discussed in previous articles, I begin my morning preparation by reading the SpotGamma AM Founder’s Note when I plan to trade futures. For ES futures, I note gamma levels, the SpotGamma Imp. 1 Day Move, the SpotGamma Gamma Index, and Gamma Notional for […]

The Volatility Trigger for ES Futures Traders

Wednesday 5/27 was a great example of how the Volatility Trigger can be a key level in trading. The concept of the volatility trigger is that when the market moves below the Trigger, options dealers are short gamma. This may mean that they start to sell futures as the market moves lower, and but futures […]

Volatility Trigger INDICATOR KEEPING LID ON MARKET 8/9/19

SpotGamma calculates the market level at which options dealers gamma position flips from long to short. We call this the “VOLATILITY TRIGGER” indicator. Below this S&P500 price dealers trading can increase market volatility, and over this level their trading may damped volatility. You can see over the last two days the markets drove hard into […]