What’s Next for Tesla Stock? Understanding a Gamma Squeeze

Market Analysis

How a 2,360% Jump in Call Options Fired Up Tesla’s Share Surge

From Bloomberg: The interplay between the equity and options markets can be complex. To illustrate the dynamics, Brent Kochuba, founder of analytic service SpotGamma, plotted Tesla’s stock against delta, or the theoretical value of stock required for market makers to hedge the directional exposure resulting from all options activity. In the simplest form, when someone […]

SpotGamma Report for: 10/26/2021 AM

### You must be logged in to access this content. Don’t have an account with SpotGamma? Sign up today to view unique key levels, Founder’s Notes, market commentary, options analysis tools, and expert insights. If you’re already a SpotGamma subscriber, log in here: Username or E-mail Password Remember Me Forgot Password

Trade Analysis: ES Futures (22 October 2021)

The following is a guest post from Doug Pless. As I have discussed in previous articles, I begin my morning preparation by reading the SpotGamma AM Founder’s Note when I plan to trade futures. For ES futures, I note gamma levels, the SpotGamma Imp. 1 Day Move, the SpotGamma Gamma Index, and Gamma Notional for […]

Huge VIX Contago!

There was an interesting twitter thread yesterday which correctly pointed out the very large contango in the VIX futures market. Specifically we had the VIX index trading nearly 4 points below that of the front month VIX future [VX1]. Currently the VIX is trading near 15, and that future is near 19. According to the […]

Weakening US Dollar Sparks Short-Squeeze Rally

The following is a guest post courtesy of Michael Kramer of Mott Capital Management. Stocks ripped higher the week ending October 15. The spark stemmed from a sharp decline in the dollar index, as the currency market grew concerned about hotter than expected wage growth as part of the US Consumer Price Index the morning […]

The SEC on GME: SpotGamma’s Analysis

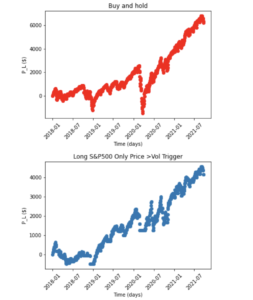

Vol Trigger Study

Trade Analysis: ES Futures (12 October 2021)

The following is a guest post from Doug Pless. As I have discussed in previous articles, I begin my morning preparation by reading the SpotGamma AM Founder’s Note when I plan to trade futures. For ES futures, I note gamma levels, the SpotGamma Imp. 1 Day Move, the SpotGamma Gamma Index, and Gamma Notional for […]

YouTube Live: 10/12/21 2PM ET Notes

Join us today at 2pm ET as Brent from SpotGamma talks with Imran from Options-Insight. SOFI Gamma Squeeze HIRO: Hedging Impact of Real Time Options BITCOIN Energy EXTRA CREDIT – AMC REALIZED VS IMPLIED