Its interesting too look back at where we were in February ’20 just days before the crash. Clearly things are different now, and we are suggesting a >30% drawdown (for one, the put fuel isn’t there). However its interesting to compare sentiment and data particularly as we have hit a double top just before a […]

February 2020 crash

When Might this Volatility End?

We have been targeting next weeks OPEX 3/20 as a key time in this “volatility cycle” as there is very large open interest. As that open interest is closed or rolled it may allow some calm as call options are re-struck closer to at-the-money and put options are rolled out and down. This could effectively […]

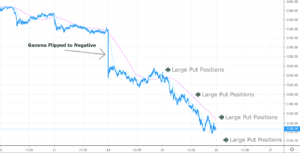

February 2020 Selloff & Gamma Trap

There has been relentless selling during the end of February attributed to Coronavirus fears. There are clearly sellers of all types active in the current market, but much of this selling may be attributed to negative market gamma and the “gamma trap”. As you can see below on over the weekend of Feb 24th futures […]

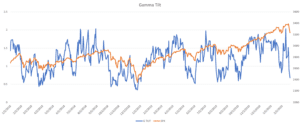

Gamma Tilt & Market Bottoms

One of the indicators we watch for a potential bottom is Gamma Tilt – or the ratio of call gamma to put gamma. When this level hits lows it may be an indication that the market is oversold. Currently the S&P500 Index is about 8% in ~5 trading days. Here is the current indicator for […]