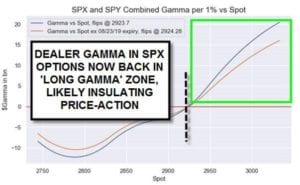

Nomura published an updated gamma chart showing that options dealers are now “Long Gamma…likely insulating price-action”. Nomuras options gamma estimate of 0 at 2923 is essentially the same level as our “Volatility Trigger” which is 2920. The issue with their analysis is that appears to be jumping the gun. Zero and positive are not the […]

nomura

SpotGamma Trading Levels Vs Nomura

Here is a report from Nomura compared to the same days market forecast from SpotGamma.com. Notice the “zero gamma” levels are the same in both reports at 2935 in the S&P500. We call the “zero gamma” level “volatility trigger”. Using this level can help forecast the level of stock market volatility. Under this market price […]

Nomura: Volatility Crush Market Options Gamma on CNBC

Nomura analyst on CNBC discussing how dealer gamma effects the equity market. He mentions the large open interest in the VIX (“50 Cent”) and how a volatility crush could spur an equity rally. This is because (as seen through the SpotGamma model) a drop in volatility forces dealers to rehedge through buying stocks. As the […]