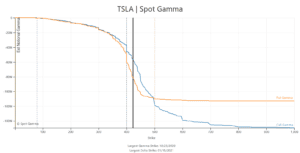

TSLA announced earnings last night which beat expectations and the stock reacted… fairly normally. No insane pops or drops. We think much of this tepid reaction is due to the relative lack of gamma compared to past earnings periods (see here). Below is a chart of the current gamma levels in TSLA, and you can […]

TSLA

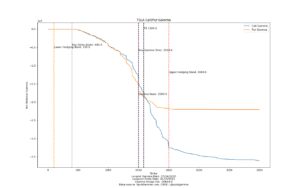

TSLA Options Pre Earnings

TSLA reports earnings tonight, and there is a ton of options gamma to generate a large move tomorrow. We define key levels for the stock as follows: Lots of Gamma at 1500 – thats the “pivot” area where stock remains a bull above, bear below. There are a ton of in the money calls at […]

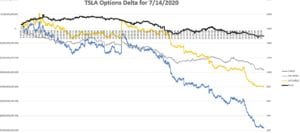

TSLA Options Deltas

We show TSLA having the 1500 as the key options strike going into Friday 7/17. The stock yesterday breached 1750 before pulling back to 1500. Its clear the options flow changed when the stock tagged that 1750 area as you can see in the chart at bottom. Friday will such and interesting date fore the […]

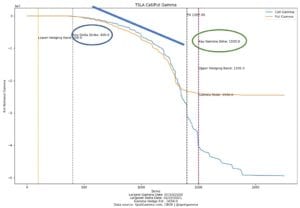

TSLA Convert Bonds Options & Gamma Traps

We think that much of what has pushed TSLA’s massive runup in price has been a “gamma trap“. The idea being that in-the-money long calls and new long call positions force dealers to buy the stock as it goes higher. Our model detects a lot of very deep in the money <=400 strike calls, which […]

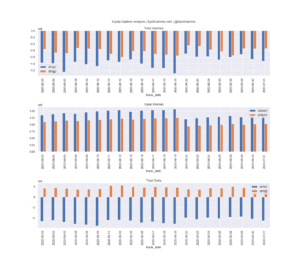

Equity Options Gamma Shows Stretch

Our equity options gamma indicators are showing that negative gamma rates in single stocks are growing back to where record levels were a few weeks ago. Back then there was news of “record small trader” positions in call options. You can see there is a similar position below. In the charts below for TSLA, AMZN, […]