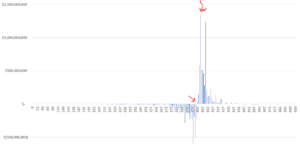

A combination of new regarding the Chinese virus spreading and Iraq being bombed sent futures lower on Monday AM. Oddly the low of the overnight session was 3237, which we calculated to be the zero gamma threshold. Remarkably the same thing occurred a few weeks ago on the eve of the Iranian bombing. Should the […]

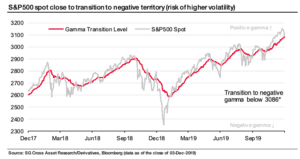

zero gamma

SocGen Zero Gamma Chart History

Here is a backtest of where SocGen calculates where positive gamma changes to negative gamma in the S&P500 (SPY). You can view our historical chart here. The concern is that a move through the zero gamma level may set a “gamma trap“. Our FAQ has more information: Zero Gamma Level: This is the estimated level […]

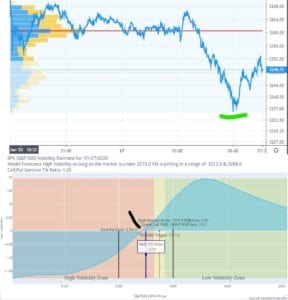

SPY Gamma Visualization

Below is a chart of gamma across all strikes in SPY. You can see that there is a large amount of gamma supply at 305 (right most arrow) and gamma flips from positive to negative around 301. It is below that strike where our model predicts increased volatility as dealers go from buyers to sellers. […]

Volatility Trigger INDICATOR KEEPING LID ON MARKET 8/9/19

SpotGamma calculates the market level at which options dealers gamma position flips from long to short. We call this the “VOLATILITY TRIGGER” indicator. Below this S&P500 price dealers trading can increase market volatility, and over this level their trading may damped volatility. You can see over the last two days the markets drove hard into […]