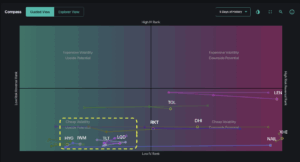

Overall price stability in the S&P 500 is masking one of the most unusual equity environments in recent years. While SPX has been roughly flat over the past month, the average constituent has moved 10.8% — a 99th percentile dispersion reading, as we discussed in our Thursday AM Founder’s Note. All signs point to increasing fragmentation beneath […]

Market Analysis

The Market’s 0DTE Underbelly Is Exposed

Last week reminded us just how fast market stability can give way to volatility. After trading near all-time highs at 7,000, the S&P 500 fell 3% in just three sessions, closing Thursday at 6,798 amid weakness in software and crypto. Our last Sunday Newsletter focused specifically on how this type of fragility underscores today’s market. This […]

SPX Touches 7,000 and Cracks — What Makes This Market So Fragile?

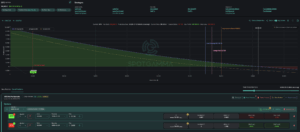

Market Fragility in the Face of All-Time Highs As the S&P 500 pushes record highs, the options market continues to flash warning signals beneath the surface. Underlying risk from volatility discrepancies and index-equity correlation suggest an environment prone to vol spasms — similar to what we witnessed with Thursday’s (1/29) sharp selloff and reversal. These […]

Vanna Fuels Market Rally as Market Fears Subside

Last week began with fear dominating market sentiment: analysts widely attributed Tuesday’s 2% SPX selloff to Greenland worries and tariff threats. As we pointed out in last weekend’s newsletter, traders had begun hedging against downside risk as put skew increased and volatility premiums rose. However, the quick turnaround back to SPX 6,900 seemed to erase any […]

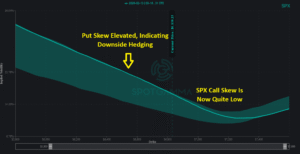

Defensive Positioning Emerges as Market Rallies

Traders Turn Defensive In the Face of Market’s Climb SPX tested fresh all-time highs last week, with positive gamma providing guardrails for the broader market. In the face of headline noise—from criminal investigations into Powell to Iran-related escalation—the market absorbed every dip, with the 6,890 Risk Pivot level from Monday’s AM Founder’s Note holding firm. However, increasing put skew and […]

Vol Stays Quiet as SPX Reaches All-Time Highs

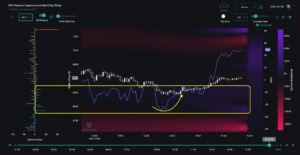

Strong 0DTE Support Lifts the Market to Record Highs The S&P 500 kicked off 2026 by grinding through a week of macro data releases to finish at fresh all-time highs on Friday. SPX closed at 6,966, up from the 6,902 open on Monday, after finding critical support in the 6,890–6,900 zone multiple times throughout the […]

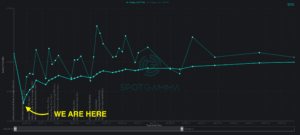

Record 0DTE volume reshapes the S&P 500

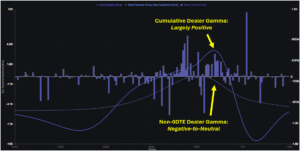

Record 0DTE Volume in 2025 Has Changed the Game We wrapped up 2025 with the S&P 500 up 18% for the year—a solid result in the face of tariff headlines, global conflicts, and inflation concerns. One of the major options market stories of the past year has been the growing role of 0DTE options: same-day expiration […]

Subdued Volatility and the Setup Into Year-End

Subdued Vol Meets Negative Gamma Weakness in AI-related stocks dominated market headlines last week, most notably for Oracle and Broadcom. This pushed the market downward, before the rebound on Thursday and Friday. Despite the market trending down for three consecutive days, implied volatility remained surprisingly subdued: put skew remained average, and ATM implied volatility sat […]

FOMC Reset: Vol Crushes, Stocks Lift Higher

Last week began with quiet anticipation of Wednesday’s FOMC. When the Fed announced the 25 basis point rate cut and Treasury bill purchases, the reaction was immediate. Equities surged, with the SPX breaking out above our 6,845 Volatility Trigger to approach all-time-highs near the 6,900 resistance level. The options market had priced in meaningful event-related volatility surrounding FOMC, and […]

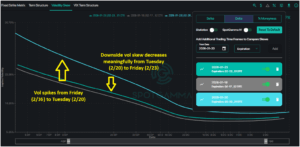

How the Options Market is Positioning for FOMC

Markets hovered near all-time highs last week as traders eagerly await next week’s FOMC. The SPX traded in a tight 6,800-6,900 range, while volatility compressed to multi-month lows: VIX dropped 15% this week to 15.4, experiencing some of the lowest values since September. This is a trend we’re watching closely: Softer demand for volatility (options) […]