Every June, the Russell Index rebalances by removing stocks that no longer meet their criteria. After a wildly popular start to 2021, will meme stocks like GME and AMC get added to Russell this year? Many traders are starting to discuss the upcoming Russell Index rebalances, and the prospect of GME, AMC or other meme […]

Market Analysis

Anatomy Of A Short Squeeze: This Is How Hedge Funds Pounce On Retail Meme Stonks

BY TYLER DURDENWEDNESDAY, JUN 09, 2021 – 12:31 PM In the ‘old normal’ – when dinosaurs roamed the earth – history suggested that when retail investors piled into stocks with both hands and feet, a major top in prices was usually not far behind. But, in the ‘new normal’ of Reddit Rebels and Meme Stock Manias, it is the ‘little […]

Meme’s are Likely Less Retail

The prevailing narrative with these large meme-stock movements is that entities like the wallstreetbets message board are responsible for amazing returns. Its a wonderful story of the retail “David” vs the Wall Street “Goliath”, and how these new forums are changing the long held dynamics of how markets work. We certainly believe there is a […]

How To Keep The Gamma Squeeze Going With Put Sales

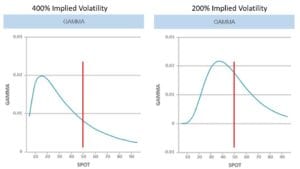

Here’s why paying too much for a call option can actually go against a stock squeeze It was just a few months ago that the effects of “Gamma Squeezes” became main stream knowledge. YouTube streamers and Reddit message boards now espouse the impact of call options in the markets, pushing their tribes to “buy stock, […]

Brent From SpotGamma on RealVision’s Zer0es TV

In this flash update, Brent Kochuba, Founder of SpotGamma, discusses the eye-popping short squeezes in the meme stocks. Understand the dynamics behind GameStop, AMC & Bed, Bath & Beyond.

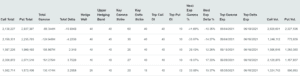

AMC Equity Hub Options Outlook

AMC was up 95% FOR THE DAY yesterday, with a close at 62.50. The big news this morning from AMC is that they plan to sell another 11.5 million shares, following another sale earlier this week. AMC plans to sell 11.5 million shares and cautions investors: “Our current market prices reflect market and trading dynamics […]

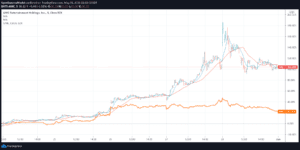

AMC Gamma Squeeze in Review

“Gamma Squeeze” was grabbing headlines again this past week after AMC and GameStop (GME) both surged in price. While GME returned +22% for the week, it was AMC that had blow-out returns of +103% and we think much of this price action was driven by a call options gamma squeeze. The graph below lays out […]

AMC RKT Gamma Squeeze: “Escape Vol-ocity!”

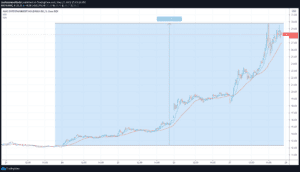

AMC, RKT and other meme stocks are ripping higher due to an options gamma squeeze. As traders buy call options, options market makers must buy stock to stay hedged. We believe this hedging flow is whats causing massive stock moves. AMC is up nearly 140% this week alone. As you can see the stock hit […]

Nomura: US Stock Markets Are “Stuffed To Death On Options Gamma”

BY TYLER DURDENWEDNESDAY, MAY 26, 2021 – 11:55 AM It may not feel like it, but the market is pretty much dead: as we noted last night, Tuesday’s consolidated volume just tumbled to the lowest of 2021, while total options volume yesterday was 540,000, which was less than Christmas Eve and also the lowest volume […]

GME Getting Squeezed…Again?!?!

GME may be setting up for another options gamma squeeze as it approaches June 8th earnings. While GameStop stock is pushing higher, the cost of call options are very high, which may cap some of that gamma squeeze.