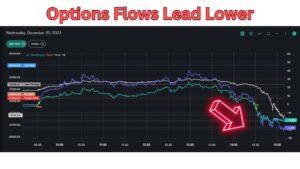

On 12/20 the S&P500 experienced its sharpest selling in over 3 months, as the index rapidly declined 1.6% – seemingly out of nowhere. SpotGamma, in real time, flagged 0DTE trading as a likely culprit in a now-viral tweet: Its a 0DTE driven plunge in the S&P. you can see the spread here between bearish 0DTE […]

Market Analysis

The OPEX Effect: November 2023

Listen to “The OPEX Effect” podcast – targeted to those of you will investing time frames past a few weeks. Here we cover some interesting trends in equity volatility, and breaking its link to interest rates. Also some call buyers in both the Magnificent 7 & cryptos.

Options Flow for ES Futures Traders

Brent from SpotGamma and pro futures trader Scott Pulcini walk through how futures traders can gain edge through options markets levels and flows.

Measuring Options Vanna, and its Impact, using VIX & Skew

In this video SpotGamma breaks down how to measure vanna impact, and why changes in options implied volatility can be a major driver of stock prices. We cover core concepts like, volatility premium, skew, and gamma.

October OPEX – SpotGamma Views + OPEX Download

Enter your email below to receive our latest OPEX spreadsheet, which details the size and activity of the options positions for top stocks! In the video below, Brent, Founder of SpotGamma, and Imran of Options-Insight, discuss the dynamics heading into this weeks October Monthly expiration. Specifically they cover the impact of geopolitics on volatility, the […]

SpotGamma with the Wall Street Journal on the Rise of 0DTE

Brent, Founder of SpotGamma, was featured in a video presentation with the Wall Street Journal discussing the rise of 0DTE options trading. Watch here.

October OPEX Effect with Excess Returns

The 0DTE ETF: Defiance ETF QQQY

Defiance ETFs introduces a new fund, the Defiance Nasdaq 100 Enhanced Options Income ETF (ticker QQQY), tapping into the trend of zero-day-to-expiration contracts (0DTE). Defiance also plans to expand its offerings with derivatives linked to the S&P 500 and Russell 2000. Designed to maximize income, QQQY writes puts on the Nasdaq 100, seeking to offer […]

Triple Witching September 2023 OPEX a Volatility Chokepoint

There are several major events colliding in mid September, with 9/13 CPI printing in-line with traders expectations. We now turn to 9/15 OPEX is quite large. Triple Witching OPEX Sep OPEX times with several major events: Our view is that Septemers large expiration has suppressed volatility for the last several weeks, as seen in the […]

Analysis: The CBOE 0DTE Report

Everyone’s talking about options flows and how same day (0DTE) trading is impacting market prices. While options flows do not drive stocks *all* of the time, there are critical moments when these flows directly influence stock prices. For 0DTE in particular, it’s the buildup of Delta that can move markets. In September 2023, the CBOE […]