BY TYLER DURDENWEDNESDAY, MAY 26, 2021 – 11:55 AM It may not feel like it, but the market is pretty much dead: as we noted last night, Tuesday’s consolidated volume just tumbled to the lowest of 2021, while total options volume yesterday was 540,000, which was less than Christmas Eve and also the lowest volume […]

mcelligott

‘Gamma Tilt’ Suggests More Downside In Stocks As “Bigly” Op-Ex Looms

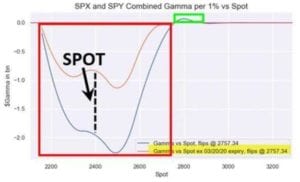

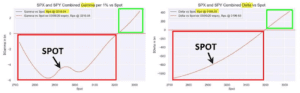

From ZH: BY TYLER DURDENTHURSDAY, MAY 20, 2021 – 11:15 AM Nomura’s Charlie McElligott summarized things heading into the weekend perfectly for traders: “Op-Ex tomorow matters ‘bigly’ for Equities.“ Critically, he explains, there remains likelihood of continued “chase-y” moves in both directions on dealer delta hedging due to the magnitude of the positioning out there: Latest estimates show […]

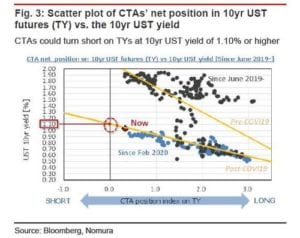

ARKK Gamma & What’s Really Behind The QQQrash? Nomura Gamma

From ZH: Nomura’s “futures imbalance” monitor showed enormous sell pressure all day in NQ futs across all lots sizes (the largest in at least 1m), but particularly in our medium- and large- lot buckets, proxies for large HFs and Asset Managers aggressively selling / shorting… Two things were behind the QQQcrash – ARKK’s vicious circle and CTA Deleveraging. […]

Nomura’s McElligott Talks Gamma on Macrovoices

Charlie McElligott talks several macro themes, and digs into deal gamma around the 44:30 mark. Topics include gamma flips, CTA deleveraging levels, and the large gamma dynamic.

Nomura McElligot Options Gamma Update

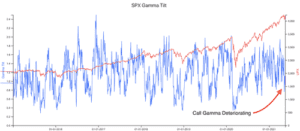

From ZH Update (1000ET): It appears the unclenching has begun! * * * While the S&P has been weaker since Friday’s opex, Nasdaq is the “messiest” due to the index-level price-movement “unclenching” based upon the sheer amount of $Gamma running-off post last Friday’s Op-Ex. As Nomura’s Charlie McElligott notes, the effect was particularly notable in […]

“Hard Purge” – Nomura Warns The Vol Market Signals Risk Of “Outright Crash Down”

From ZH As we detailed earlier, futures were down quite sharply to start the overnight session only to stage a significant recovery to current highs (perhaps on the back of a lack of glaring clearing issues… for now… appearing over the weekend). However, as SpotGamma notes, despite this move higher the options structure deteriorated, and we will […]

1/20/20 Nomura Update

From ZH: Earlier today we discussed last week’s “very large” options expiration, which as SpotGamma calculated sparked a ~50% reduction in single stock gamma, which on one hand has left markets vulnerable to short-term volatility but on the other – as Nomura’s Charlie McElligott poetically put it – sparked a “gamma unchlenching” as evidenced by […]

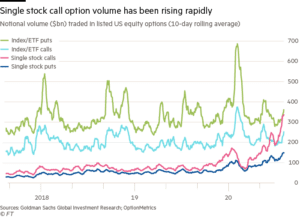

SoftBank unmasked as ‘Nasdaq whale’ that stoked tech rally

From the FT Please use the sharing tools found via the share button at the top or side of articles. Copying articles to share with others is a breach of FT.comT&Cs and Copyright Policy. Email licensing@ft.com to buy additional rights. Subscribers may share up to 10 or 20 articles per month using the gift article […]

Nomuras Pre-OPEX Market View

We wrote a few days ago about the importance of tomorrows 3/20 options expiration because of 1) its sheer size and 2) its amount of deep in the money puts. ZeroHedge adds to this sentiment with some notes from Nomuras McElligott: this “large decline in the gamma post-expiration” should allow markets to pivot back to […]

March ’20 Nomura Gamma

Great post from Heisenberg about Nomura and SocGen Gamma reports below. This chart went up on Thursday 3/5 – here is the SpotGamma gamma chart for reference: In “We’re All Momentum Traders Now”, I spent quite a bit of time attempting to drive home one overarching point: Directional moves over the past two weeks have […]