Today AAPL stock cratered after announcing a cut in iPhone 14 production. Options flow may have helped traders identify the stock low – we walk you through how.

Market Analysis

Founders Note for: 2022-10-17 06:58 EDT

Macro Theme: Key Levels: –> Range Into October OPEX (10/21): Top: 3750 Bottom: 3500 Put Wall–> 10/13 CPI likely triggers a multi-day directional trend to 10/21 OPEX Ref Price: 3585SG Implied 1-Day Move: 1.3%SG Implied 5-Day Move: 3.03%Volatility Trigger: 3750Absolute Gamma Strike: 3700Call Wall: 3835Put Wall: 3500 Daily Note: Futures have recovered from Fridays close to 3640. […]

HIRO Updated Algo Logic & New Features

HIRO Webinar 10/11/22 [00:00:00] What we’re here to do today is to discuss some of the changes that we’ve made in Hero. Whether we launched last Friday, and just talk about what those changes are and how you may, may be able to take advantage of those. So the basic dashboard obviously looks the same […]

2022: The Year of The Put & Why It Matters

Measuring Skew, Volatility & Tail Risk With Scott Nations

With huge levels of volatility in markets, Brent Kochuba, Founder of SpotGamma, spoke with Scott Nations, Founder, Nations Indexes about their options indexes. Brent & Scott discuss these innovative options metrics including: NOTE: Below is a searchable transcript of the discussion, with timestamps. As its an automated transcript, please forgive any grammatical errors. Nations Index […]

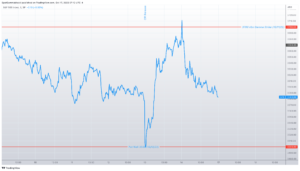

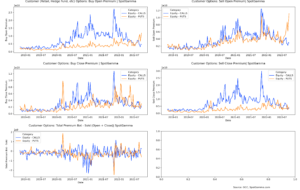

Record Put Buying? Yes, But Record Put Selling, Too.

There are some charts being passed around that show record equity put buying. While this is correct, it ignores the fact that there is also record put selling. We break down the source of this OCC options data, and what insights it may offer. Note that SpotGamma subscribers have access to this interactive data, free, […]

How Options Expiration Impacts Stock Markets

SpotGamma on the Basic Links Between Options & Futures

Brent, Founder of SpotGamma, discusses what the basic links are between options flow and equity markets. Here, he covers why delta, gamma and implied volatility matter for futures traders.

Trade Analysis: QQQ (August 15, 2022)

The following is a guest post from Doug Pless. At SpotGamma, our community uses the SpotGamma AM Founder’s Note when preparing to trade index products such as the QQQ (Nasdaq 100 ETF). Specific levels to note include the following: Volatility Trigger, SpotGamma Absolute Gamma Strike, Put Wall, and Call Wall. Additional levels are the CP […]

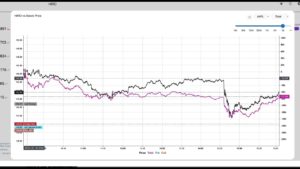

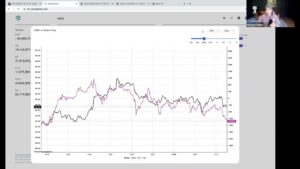

Combining SG Levels With HIRO Flow to Find Support

Here we should how combining live options information from HIRO can help to confirm key Put Wall support. Combining large gamma levels with increasing, positive deltas, has shown to be a powerful combination for finding support in markets. SpotGamma recorded and posted this video around 11:30 EST. The market rallied nearly 1% after this was […]