Using Options to Evaluate Rate-Sensitive Names With last week bringing realized volatility to the highest levels seen in 6 months, the market has entered a highly reactive state. Market events and data releases each have the potential to change the outlook for direction and volatility—and the December 10 FOMC remains the biggest date on the […]

Market Analysis

Crypto Winter or Santa Claus Rally: Which Comes Next?

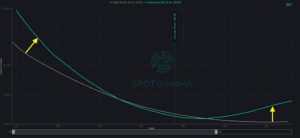

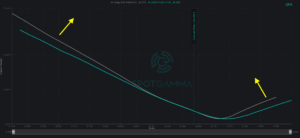

Evaluating IBIT with Positional Analysis Crypto markets have faced serious selling pressure this past month, and last Friday’s sharp decline pushed Bitcoin to yearly lows near $80K. BTC is now on track for its worst monthly performance since 2022—down 22% over the past month and negative for the year. Using Positional Analysis, we can examine […]

Negative Gamma Fuels Extreme Volatility

There’s really only one way to summarize the past few days: “What a week!” Markets delivered some of the most extreme intraday swings of the year, culminating in Thursday’s violent selloff and Friday’s equally dramatic reversal—one of the sharpest two-day sequences we’ve seen in 2025. As of Thursday, the S&P 500 was on track for the worst […]

All Eyes on NVDA as Volatility Spikes

From Market Euphoria to “Elevator Down” Markets experienced a dramatic reversal last week. Monday began with bullish momentum after the government shutdown deal was reached, yet by Thursday the market was facing intense selling pressure. Notably, SPX broke below the critical 6,800 risk pivot level we emphasized daily in our Founder’s Notes, triggering higher volatility. As […]

November ’25 OPEX Effect

Slides are available here. Nvidia, AI, and Why the Market Feels So Much Worse Than It Looks In this episode, they break down why:

SPX Down, Vol Up: What Makes Last Week’s Selloff Different

The market experienced a meaningful shift this week as SPX declined nearly 3% from the all-time highs of October 29, closing Friday at 6,729. What began as fluid, transient price action evolved into more concerning market dynamics by the end of the week. The week’s volatility behavior differed markedly from the tariff-induced selloff on October […]

The Market’s Balancing Act: Euphoria vs. Anxiety

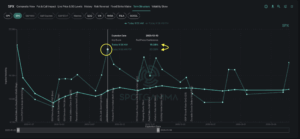

Last week, SPX tested all-time highs at 6,920 while also reaching lows near the key gamma strike of 6,815 — a journey that balanced euphoria and anxiety. Wednesday morning began with a major risk alert from our AM Founder’s Note, which was validated over the next two days: the combination of the “spot up, vol up” […]

Optimizing Options Earnings Trades

🎯 Stop Guessing Earnings Volatility — Start Predicting It If you’ve ever bought calls into a massive earnings beat… and still lost money, you’re not alone.It’s one of the most frustrating moments in trading: the stock rips higher, but your options bleed out because volatility collapses. That’s not bad luck.That’s mispriced volatility — and it’s […]

Vol Deflates, GLD Sells Off, and Earnings Season Ramps Up

Special Note: You’re invited to join SpotGamma on October 28 as we kick off Hidden Forces Unmasked, our live trader event built to help you protect PnL, outsmart volatility, and spot your next winning setup before the open. Get first access to our new Options Calculator and supercharged HIRO, along with the full suite of SpotGamma tools, free. Plus, score a shot at exclusive giveaways. Vol Deflates, […]

Volatility Returns in Time for Earnings Season

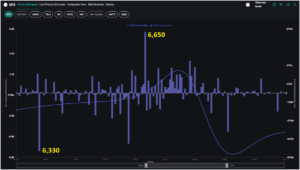

Volatility announced its return last week as the S&P 500 swung across intraday trading ranges of 150+ handles. SPX tested both the 6,550 and the 6,700 key levels we mentioned in our AM Founder’s Note on Monday before closing up 1.7% for the week at 6,674. Persistent negative gamma set the stage for heightened realized volatility, as dealers […]