$544 Billion In Options Expire Today: Here’s What Will Move From ZeroHedge While it’s not quad (or even triple) witching day, today’s a whole lot of weekly options will expire, may of which will be worthless, and others will be providing a supporting “pin” to underlying prices. It’s why, even though we are enjoying a […]

Market Analysis

The Next Gamma Squeeze

Big Banks Get Stuck… Then Unwind Before presenting our view on the next potential “gamma squeeze”, we want to share a theory of what may have driven the strong stock market performance over the last few weeks. On March 25th, it was revealed that a large fund, Archegos, had blown up. Archegos did what many large […]

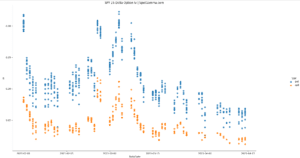

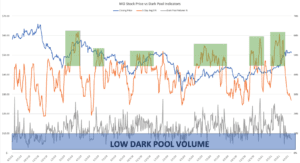

Dark Pool Example – Altria (MO)

We are excited to share how the SpotGamma Dark Pool Indicator is providing insights relative to off-market stock purchases. We have analyzed many stocks and chose to share an example of a stock with fairly average returns over the past year: There appears to be a clear takeaway that, historically, stocks tend to outperform following […]

Nomura Gamma Update

A “Fairly Rare Phenomenon” Occurs In Equity Options Land BY TYLER DURDENMONDAY, APR 12, 2021 – 10:15 AM US equity futures have traded the high to low range of Friday’s late-day meltup mania since they opened last night as a modest Asian derisking (following disappointing Chinese credit data, particularly with concerns surrounding the sharp decline of […]

SPX Options Vanna Into the April Rally

The S&P500 has been surging the last several days, following several large options expirations at the end of March. With this we have seen a change in the forecast of our vanna model, which we use to forecast dealer buying or selling pressure. Vanna is the change in an options delta for a change in […]

April 1st New Product Release

SpotGamma has released many new products to kick off Q2 2021! All of these features are available through our subscriber Portal. Not a subscriber? No problem, you get full access to our platform here. S&P500 Vanna Charts Dealers hedging activity must account for the way implied volatility shifts. We believe this can have a big […]

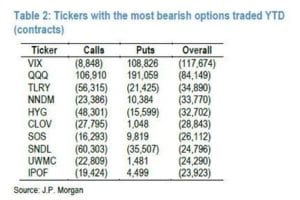

JPM Options Update

From ZH Last August, just before we learned that SoftBank was forcing a marketwide gamma squeeze in tech names, a little-followed quant at JPMorgan, Peng Cheng, came out with what may have been the most prophetic at the time market analysis, when he – unlike his “strategist” peers at major banks were trivially hiking their S&P year-end […]

Groundhog Day

The current setup feels eerily familiar. In January of ’21 we wrote a note called “When YOLO goes YOL-OH NO!” which outlined the risks embedded in this market. At that time, we viewed market downside risk was high based on: Large speculative call positions which increased leverage and market volatility Small relative put positions which […]

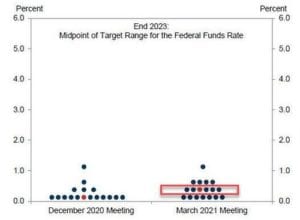

Pre FOMC Nomura Gamma Update

From ZH: With less than 24 hours to go until one of the most closely watch Fed announcements in a long time, the VIX finds itself hanging just below 20, the gamma gravity in the S&P is at 4,000 while dealers remains short Nasdaq/QQQ gamma (which however is shrinking by the day). In short, depending […]

SpotGamma on The Market Huddle

Brent (Founder of SG) was on The Market Huddle this week, starting at the 1:00:00 mark: