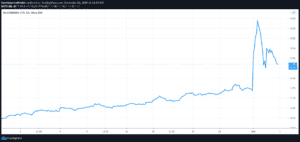

Note that last candle, which closes the stock at $695 – the days high. Did someone really just pay $695 for $TSLA shares? pic.twitter.com/zi5UrJopbq — Joe Weisenthal (@TheStalwart) December 18, 2020 TESLA TRADING VOLUME AT 180 MILLION AS STOCK SETTLES AT END OF SESSION, TURNOVER AT $122 BILLION — *Walter Bloomberg (@DeItaone) December 18, 2020 […]

Market Analysis

TSLA into the S&P500

In TSLA the largest gamma area was $600 heading into today. The stock traded down to $605 earlier this AM, $620 now. The largest volume & OI region is >=$650 44% of TSLA gamma exp on close of12/18, by which time ~$50bn of TSLA stock needs to be bought by S&P indexers

Nomura + SpotGamma – 2.5 Trillion Reasons To Care About This Week’s ‘Quad Witch’ Options Expiration

2.5 Trillion Reasons To Care About This Week’s ‘Quad Witch’ Options Expiration From ZeroHedge:Tue, 12/15/2020 – 11:55 Like all December option expirations, this month’s is large, with $2.5tln of SPX-linked options notional (linked to 8% of the S&P’s market cap) expiring on 18-Dec, but for a December, it is not extreme… Nomura’s Charlie McElligott notes […]

TSLA Timeline into the S&P500 Add

TSLA will be added to the S&P500 Index next week, and will be approximately 1.5% of the index. We covered the mechanics of this add, here. The chart below highlights the key recent events, and some relevant future dates. The “$” markets indicate where Musk has received a bonus in the form of TSLA options. […]

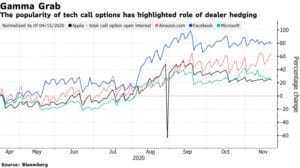

Nomura Uses Our “Weaponized Gamma” Phrase

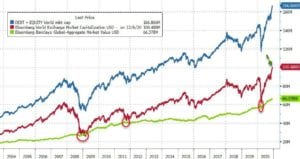

It was SpotGamma that coined the phrase “weaponized gamma” which Nomura uses to describe the current call mania. Read more from our September 8, 2020 post, “No, Softbank Didn’t Weaponize Options Gamma.” From ZeroHedge: The ongoing meltup in stock markets lifted global market caps above $100 trillion for the first time in history yesterday… Source: […]

Bookmap Presents: Index vs ETF Options Volume

SpotGamma gave a presentation to Bookmap users about the impact of ETF and Index options on ES futures.

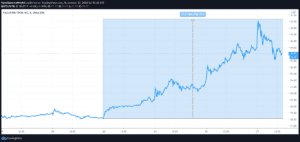

BlackBerry BB Options Decay

Blackberry stock surged after news it was working with AMZN. This led to massive call buying, which likely helped to push the stock up as dealers must delta hedge. You can see the stock pushed up near 10, and is currently down at $7. As call buyers stopped theta stepped in, and all those calls […]

SoftBank Unwinding Options Book

From Bloomberg: The Japanese conglomerate is letting its options expire, instead of maintaining its positions, the people said, who declined to speak publicly. About 90% of the contracts will close out by the end of December. The fair value of SoftBank’s futures and options positions came to $2.7 billion at the end of September, or […]

PLTR Surges on Call Buying

PLTR stock is up 20% today and as much as 80% in a week. While Citron has initiated a short into this rise, bullish Palantir posts are heavy on reddit/WSB. Our options data shows traders have concentrated their bets at the $30 strike, with a lot of that position expiring today, 11/27. We mention this […]

Wall Street Dealers in Hedging Frenzy Get Blamed for Volatility

From Bloomberg: Two professors have just lent academic heft to a suspicion running rampant on Wall Street all year: The options market is whipsawing share prices like never before. As retail investors spur a boom in derivatives trading to rival actual stock volumes, dealers rushing to hedge themselves are said to have fueled the 2020 melt-up in tech names […]