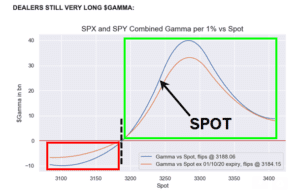

Here is an updated Nomura gamma snapshot to compare vs ours. Note we both have gamma flip at ~3185 with peak gamma around 3275. He also sees 3250 as a “pin” much as we’ve shown in subscriber reports. Thanks to Heisenberg report. “And the same song remains—SPX Dealer ‘Gamma flip’ level is meaningfully below market”, […]

gamma flip

Nomuras Gamma Model 12/23/19

We like to post Nomuras model snapshot here to compare against ours. Our volatility neutral indicator is lower, but the top matches. Some of this may be explained by Nomura combining SPY and SPX.

BusinessInsider.com Talks Gamma

A good primer on market gamma from BI: So why do markets move at all if gamma is, like in this example, the big decelerator? Because it depends who owns it. Market makers use their gamma because they must. There is nothing worse than sitting on a position and bleeding white over time as your […]

Nomura’s Gamma December Note

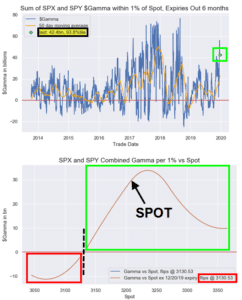

Our model has gamma flipping at 3065, Nomuras is a bit higher. From ZeroHedge The interpretation of Trump’s “better to wait until after the election” for a China trade deal comments is that the Hong Kong human rights bill sponsorship by POTUS has clearly caused agitated the Chinese side (plus this morning’s Reuters report stating […]

Volatility Trigger INDICATOR KEEPING LID ON MARKET 8/9/19

SpotGamma calculates the market level at which options dealers gamma position flips from long to short. We call this the “VOLATILITY TRIGGER” indicator. Below this S&P500 price dealers trading can increase market volatility, and over this level their trading may damped volatility. You can see over the last two days the markets drove hard into […]