Much has been made recently of the ominous “options gamma trap” and its potential effects in stock markets. What is an Options Gamma Trap? An options gamma trap is when options dealers are positioned “short gamma” and cause large swings in the stock market. To hedge a short gamma position you sell stock when the […]

open interest

Pre Open Gamma Snapshot 8/26/19

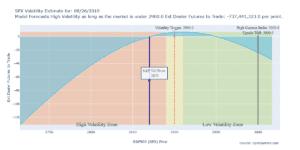

SpotGamma Model Outlook for today using a futures reference price of 2870. Dealers are short a healthy amount of gamma meaning they are going to fuel the market move at open. A short gamma position means a higher market means dealers will start buying and if the market drops at open they will sell along […]

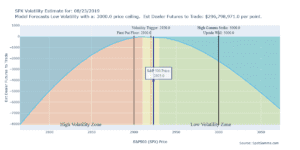

FED, TRUMP, Gamma Trap: Crazy Trading Day 8/23/19

Fed gave a speech that was “volatility dampening” at 10AM. Trump didn’t like what the Fed had to say so he started tweet-trashing the Fed and China triggering a “gamma trap“. Stock markets were just at the volatility trigger level of 2920 (black horizontal line) so the gap down flipped the trigger and dealers were […]

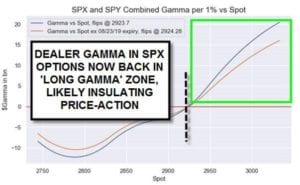

Nomuras Analyst Jumping the Gamma Gun

Nomura published an updated gamma chart showing that options dealers are now “Long Gamma…likely insulating price-action”. Nomuras options gamma estimate of 0 at 2923 is essentially the same level as our “Volatility Trigger” which is 2920. The issue with their analysis is that appears to be jumping the gun. Zero and positive are not the […]

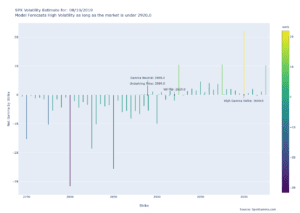

Gamma Market From 8/16/19

Volatility will continue to reign until (if) the market recaptures 2920. There is a ton of fuel ready to burn and one headline (or tweet) will send the market flying. The only recommendation that is safe here is to not sell any options, being short volatility is very dangerous here, as a >3% rally is […]

VFlip Strikes Again 8/13/19

Like Haden warned us, based on ASDFG levels, on 7/31 markets broke under the VFLIP Volatility Indicator, triggering a market environment market by high volatility. As you can see that proved true with >10 days in a row with a >1% move. With a major options expiration at the end of the week there should […]