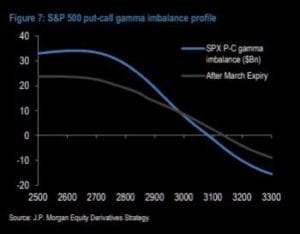

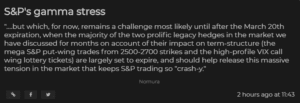

We wrote a few days ago about the importance of tomorrows 3/20 options expiration because of 1) its sheer size and 2) its amount of deep in the money puts. ZeroHedge adds to this sentiment with some notes from Nomuras McElligott: this “large decline in the gamma post-expiration” should allow markets to pivot back to […]

OPEX

The Large 3/20 Options Expiration

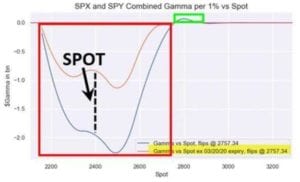

Options expiration for this Friday 3/20 is getting a lot of attention because it is so large. It may also hold the key to a major change in our “negative gamma” situation. As you can see markets remain in negative gamma territory unless we move up towards 3100-3150 in the SPX. The other way we […]

When Might this Volatility End?

We have been targeting next weeks OPEX 3/20 as a key time in this “volatility cycle” as there is very large open interest. As that open interest is closed or rolled it may allow some calm as call options are re-struck closer to at-the-money and put options are rolled out and down. This could effectively […]

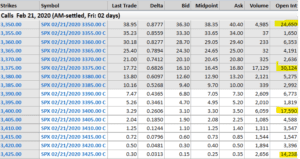

Feb 2020 OPEX Roll

Today (2/19) we are looking at the size and potential of the Feb SPX AM OPEX roll that takes place on Friday (2/21). As you can see below there are some decent sized call positions which will have to be addressed – either closed or rolled. You can see there are some decent sized positions […]

Hedging Into the Close

@VolCurve brought up a great point today – ” Don’t mistake gamma hedging for strength.” It was an interesting example today of what looks like gamma hedging moving the market into the close. The market was quite weak today, but some force kept bringing us higher towards 3300 into the close. SPX options settle at […]